Receive invoices with the e-invoice mailbox

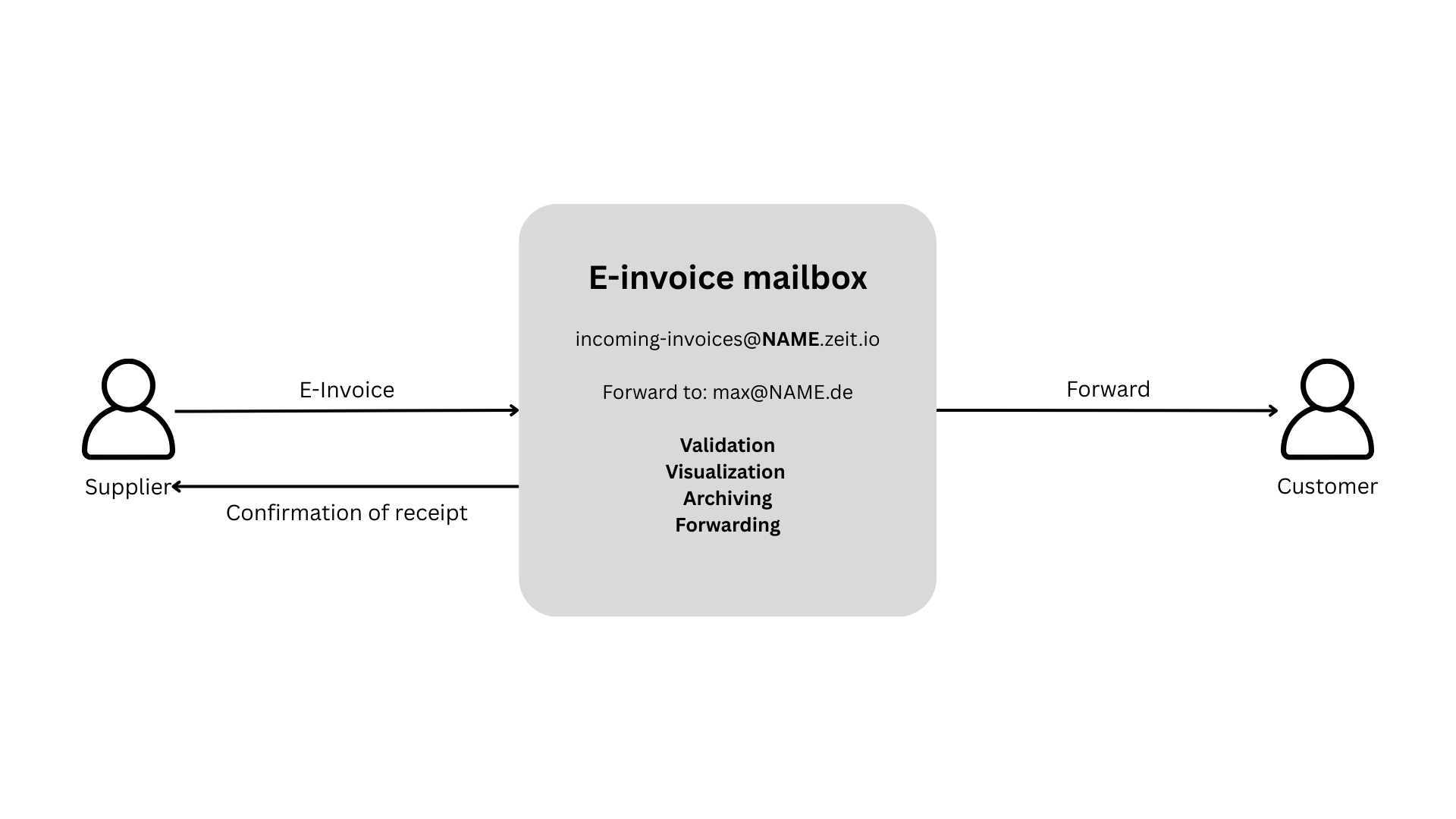

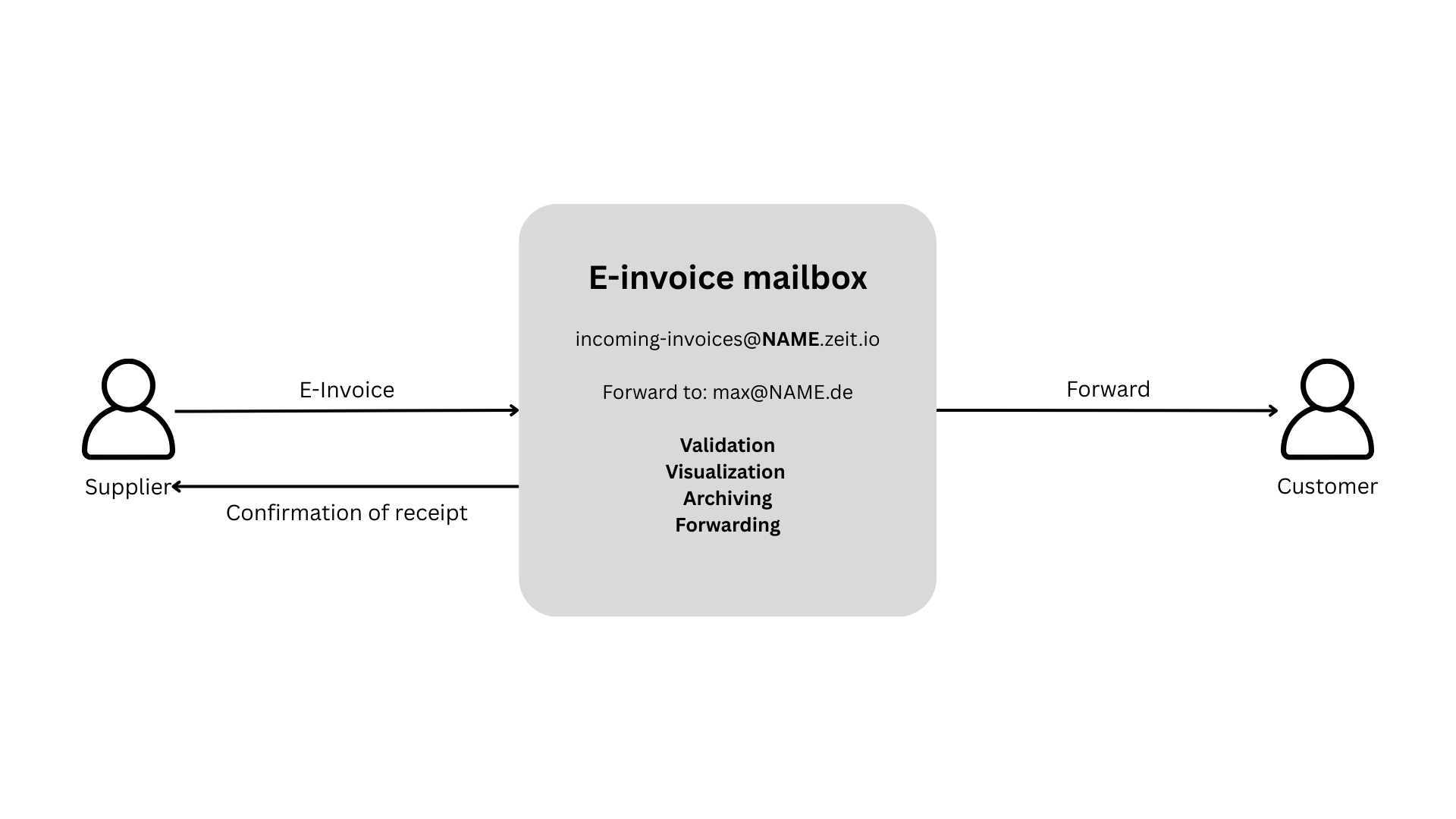

With the e-invoice mailbox, e-invoices can be received, validated, and visualized. Senders immediately receive a confirmation of receipt along with a validation report. Approved e-invoices can be easily transferred to DATEV.

Since January 1, 2025, e-invoicing has been mandatory in Germany. For B2B transactions within Germany, e-invoices must be issued in accordance with EN 16931. There is a transition period for sending e-invoices until 2027 or 2028, depending on the company's annual turnover. However, there is no transition period for receiving e-invoices.

EN 16931

Companies, freelancers, and sole proprietors are required to receive, review, and archive electronic invoices. Such e-invoices may no longer be rejected, and recipients are not entitled to an alternative invoice format – provided the invoice complies with the EU standard EN 16931! The following invoice formats are all EN 16931 compliant and may not be rejected in Germany.

- ZUGFERD from version 2.0.1

- XRechnung from version 3.0.1

- Peppol BIS Billing from version 3.0

ZUGFERD is a so-called hybrid invoice format because it consists of two components. A ZUGFeRD invoice always consists of an XML file embedded in a PDF A3 file, with XML always being the leading system. The German ZUGFeRD format is 100% compatible with the French e-invoice format Factur-X.

ZUGFERD is a hybrid invoice format because it consists of two components. A ZUGFeRD invoice always consists of an XML file embedded in a PDF A3 file, with XML always being the leading system. The German ZUGFeRD format is 100% compatible with the French e-invoice format Factur-X. The other two invoice formats are pure XML formats. These are e-invoices that consist entirely of XML and do not have their own image view.

Validation

Just as traditional PDF invoices must be checked to ensure they contain all required information, e-invoices must also be checked (validated). If a traditional PDF invoice does not have a sequential invoice number or invoice date, it is invalid and must be rejected. The same applies to e-invoices, although the verification process is somewhat more complex. Depending on the structure of the e-invoice, several hundred attributes may need to be checked. Received e-invoices must be validated for syntax correctness. ZEIT.IO's invoice receipt can validate e-invoices and shows you whether the e-invoice is error-free or should be rejected.

Visualization

According to the Federal Ministry of Finance, XML is always the preferred format for e-invoices. This applies even to ZUGFeRD invoices, which have an image view as PDFs. This means that decisions must always be based on the data in the XML. However, since most people are unfamiliar with XML, a tool that visually displays the information in the XML is essential. ZEIT.IO's invoice receipt can not only validate e-invoices but also visualize them. This provides you with a graphical representation of all the information from the XML, allowing you to see it immediately.

Archiving

The obligation to archive invoice documents is nothing new! The requirement to store invoice documents in an audit-proof manner for 10 years has existed since 2015. This requirement now also applies to e-invoices. ZEIT.IO also offers audit-proof storage for invoice documents.

Receiving

There are no specific legal requirements for receiving e-invoices. You can receive e-invoices via email, FTP, or shared network drives. This is up to the sender. However, you should ensure that the transmission path is encrypted.

You can simply drag and drop e-invoices onto the ZEIT.IO invoice inbox and receive a validation report and visualization within a few seconds.

You can simply drag and drop e-invoices onto the ZEIT.IO invoice inbox and receive a validation report and visualization within a few seconds.

The e-invoice mailbox

ZEIT.IO offers an e-invoice mailbox for both companies and freelancers. This is a separate email address dedicated to receiving e-invoices. Invoices received via this mailbox are automatically sent to the ZEIT.IO invoice inbox, where they are validated and visualized. And, if approved, they are also archived long-term.

This is not an email address that you need to configure in your email client. The ZEIT.IO e-invoice mailbox is a so-called "forwarding mailbox." Incoming invoices are reviewed and forwarded with additional information to a previously stored email address. You can also configure the sender to receive a confirmation of receipt.

e-invoice mailbox at ZEIT.IO

e-invoice mailbox at ZEIT.IO

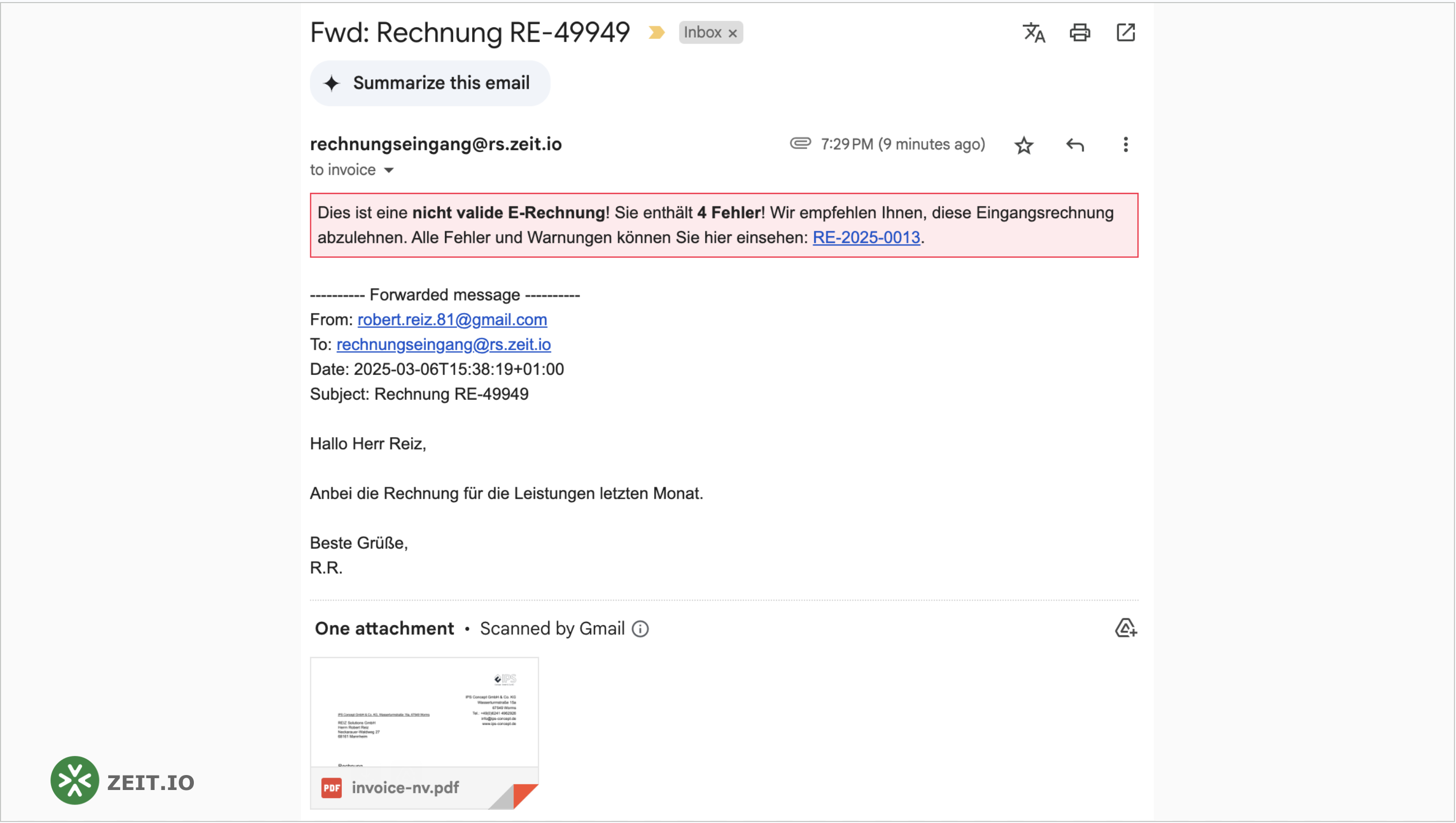

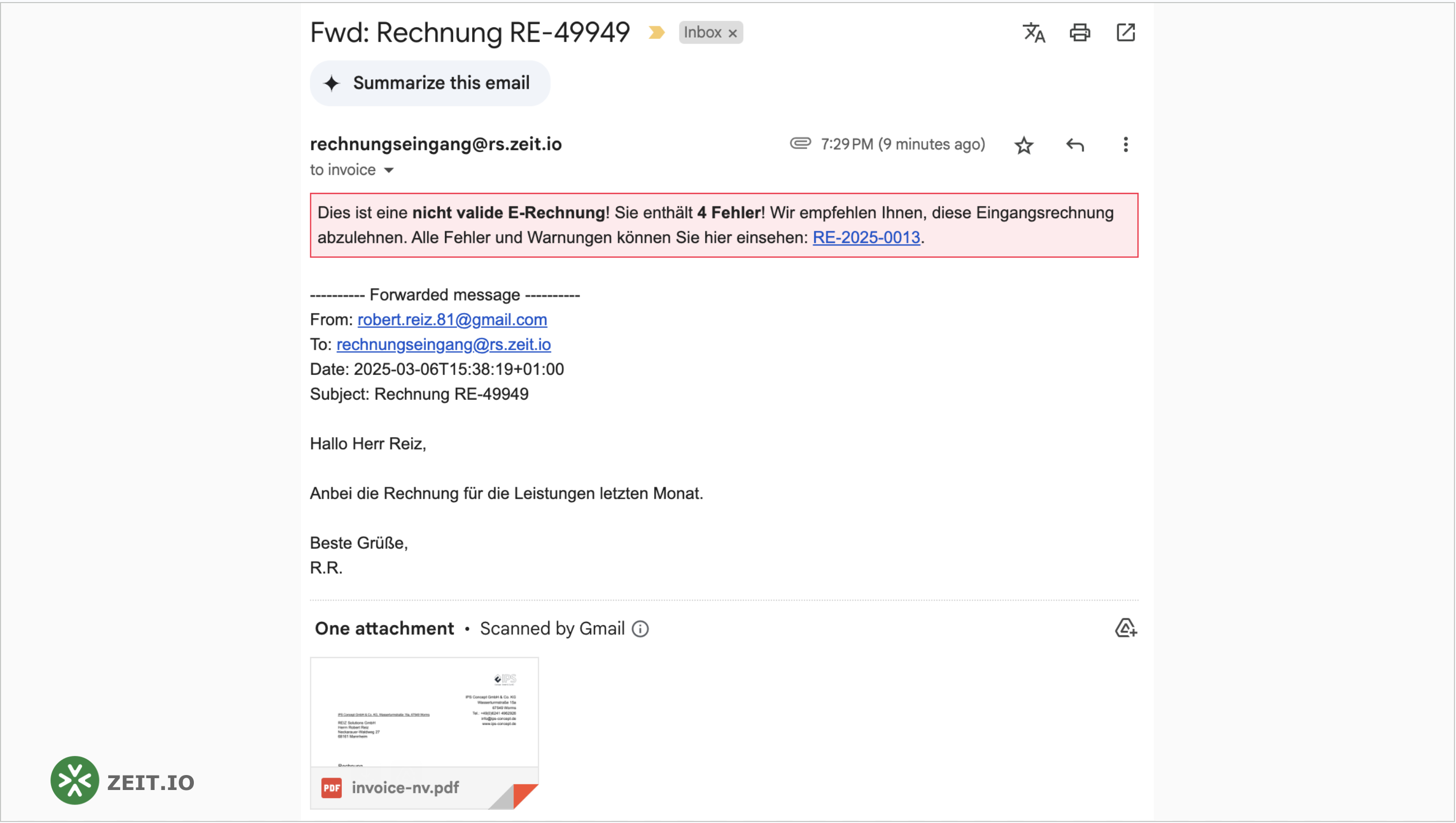

Gehen wir davon aus das Sie sich das E-Rechnungs-Postfach "rechnungseingang@agency-one.zeit.io" konfiguriert haben. Als Weiterleitungs-Adresse habe Sie ihre eigenen E-Mail Adresse hinterlegt, z.B. "max.mustermann@agency-one.com". Nun schickt Ihnen ein Lieferant eine fehlerhafte E-Rechnung an ihr E-Rechnungs-Postfach "rechnungseingang@agency-one.zeit.io". Die E-Rechnung wird aus der E-Mail heraus extrahiert, in Ihrem ZEIT.IO Rechnungseingang gespeichert und ein Validierungs-Report wird erstellt. Die empfangene Original-E-Mail wird mit einer Nachricht von ZEIT.IO angereichert und and max.mustermann@agency-one.com weitergeleitet. Diese weitergeleitete Nachricht kann z.B. so aussehen:

Forwarded invalid e-invoice

Forwarded invalid e-invoice

You will receive the original message, including the attachment. However, the forwarded email also contains the information that the attached invoice is not a valid e-invoice because it contains four errors. If you click on the link in the red box, you will be taken to the incoming invoice on ZEIT.IO and can view the complete validation report.

This will send you information directly to your inbox about whether the invoice is an e-invoice or not. If it is an e-invoice, you will also immediately receive information about whether it is valid or not!

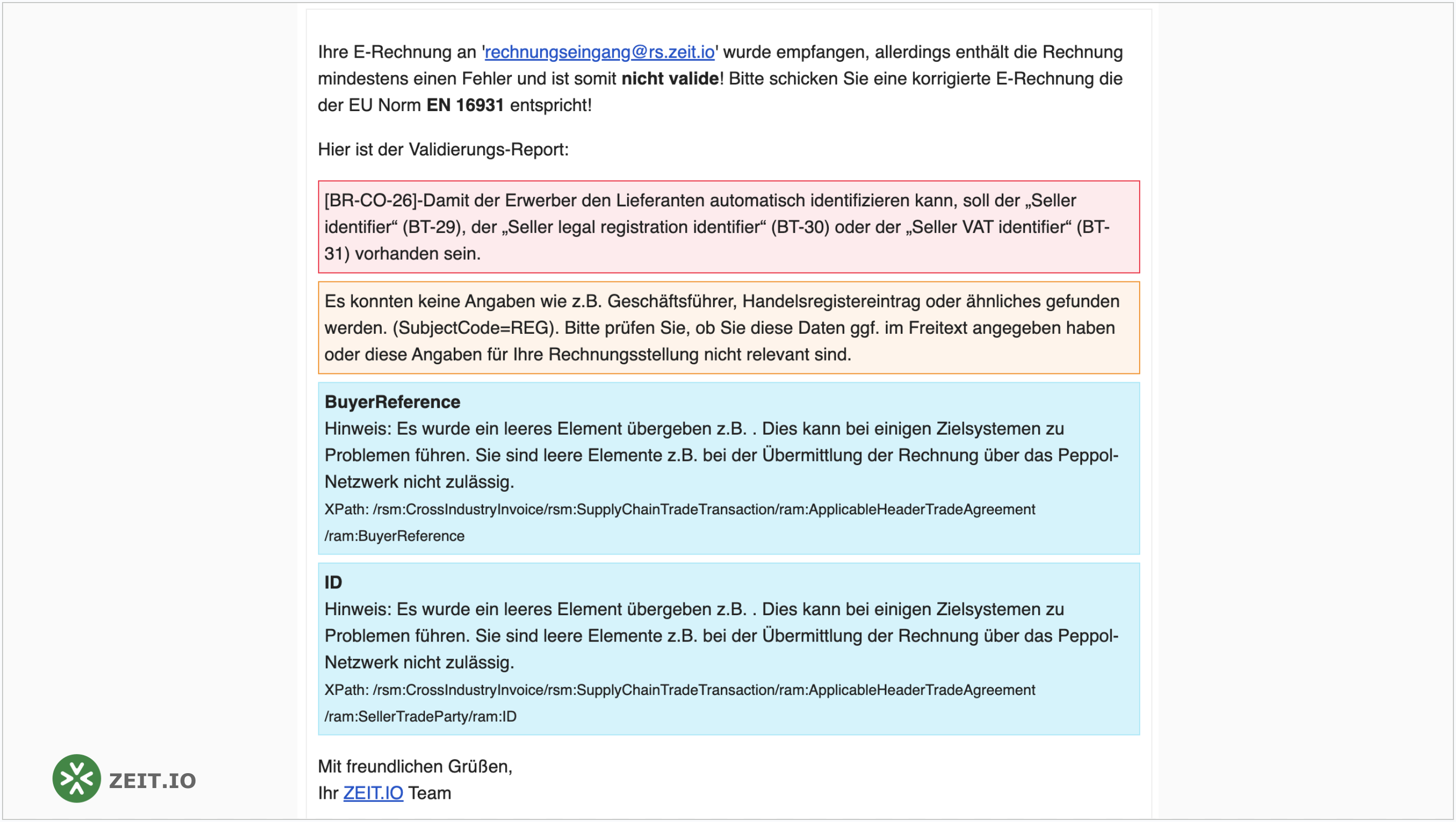

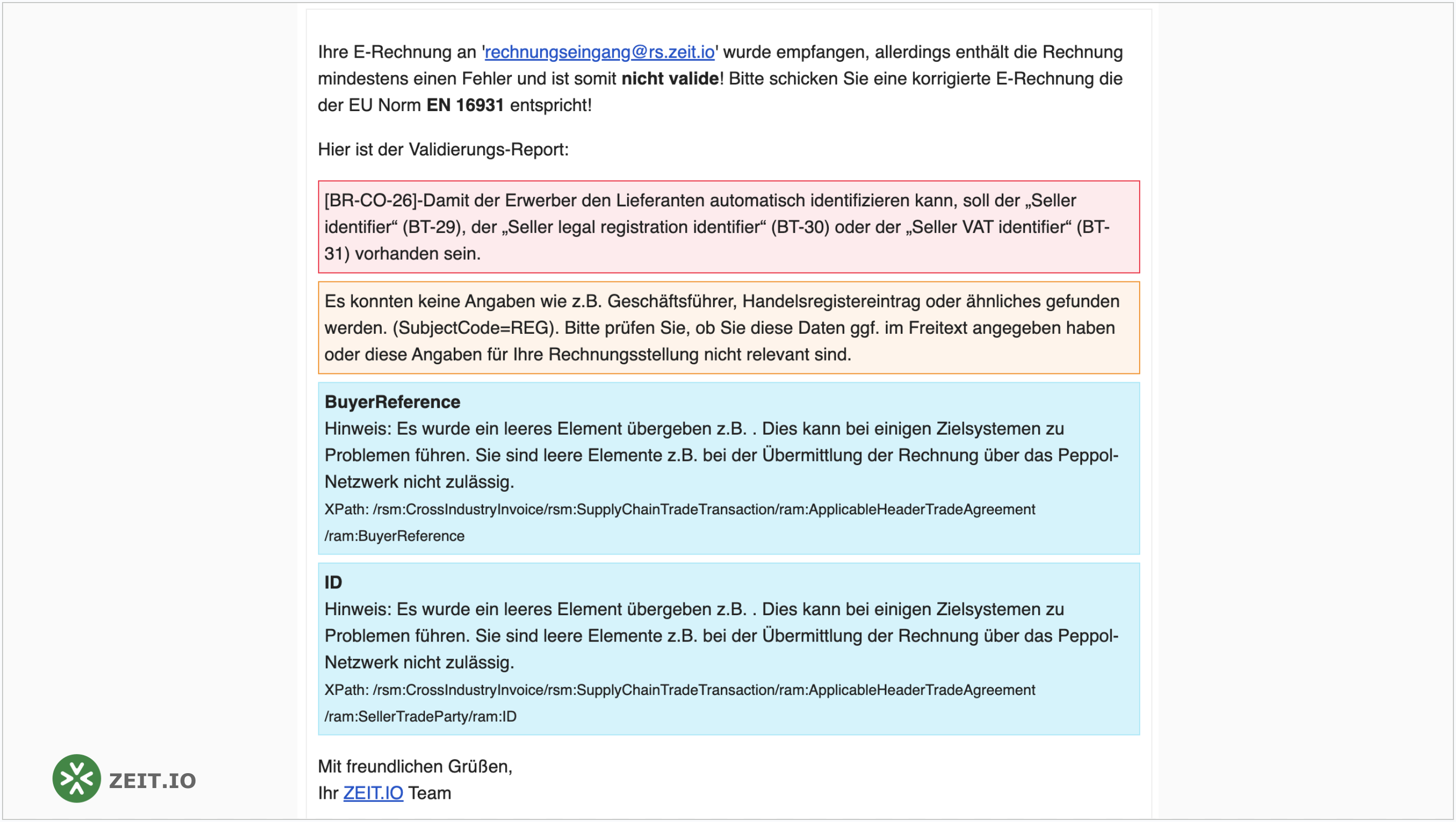

If you have activated the receipt confirmation in your e-invoice inbox, you don't even need to notify the supplier about the incorrect e-invoice, because this has already happened automatically. If the receipt confirmation is activated, the sender will receive a receipt confirmation with a validation report. For an invalid e-invoice, this might look something like this:

Confirmation of receipt for an invalid e-invoice with validation report.

Confirmation of receipt for an invalid e-invoice with validation report.

This automatically informs the sender that the e-invoice sent is invalid and must be rejected. The sender also receives the validation report in the email and can therefore understand why the recipient must reject the invoice.

The text in the forwarded emails and receipt confirmations sent in this way differs depending on the case:

This is not an email address that you need to configure in your email client. The ZEIT.IO e-invoice mailbox is a so-called "forwarding mailbox." Incoming invoices are reviewed and forwarded with additional information to a previously stored email address. You can also configure the sender to receive a confirmation of receipt.

e-invoice mailbox at ZEIT.IO

e-invoice mailbox at ZEIT.IOGehen wir davon aus das Sie sich das E-Rechnungs-Postfach "rechnungseingang@agency-one.zeit.io" konfiguriert haben. Als Weiterleitungs-Adresse habe Sie ihre eigenen E-Mail Adresse hinterlegt, z.B. "max.mustermann@agency-one.com". Nun schickt Ihnen ein Lieferant eine fehlerhafte E-Rechnung an ihr E-Rechnungs-Postfach "rechnungseingang@agency-one.zeit.io". Die E-Rechnung wird aus der E-Mail heraus extrahiert, in Ihrem ZEIT.IO Rechnungseingang gespeichert und ein Validierungs-Report wird erstellt. Die empfangene Original-E-Mail wird mit einer Nachricht von ZEIT.IO angereichert und and max.mustermann@agency-one.com weitergeleitet. Diese weitergeleitete Nachricht kann z.B. so aussehen:

Forwarded invalid e-invoice

Forwarded invalid e-invoiceYou will receive the original message, including the attachment. However, the forwarded email also contains the information that the attached invoice is not a valid e-invoice because it contains four errors. If you click on the link in the red box, you will be taken to the incoming invoice on ZEIT.IO and can view the complete validation report.

This will send you information directly to your inbox about whether the invoice is an e-invoice or not. If it is an e-invoice, you will also immediately receive information about whether it is valid or not!

If you have activated the receipt confirmation in your e-invoice inbox, you don't even need to notify the supplier about the incorrect e-invoice, because this has already happened automatically. If the receipt confirmation is activated, the sender will receive a receipt confirmation with a validation report. For an invalid e-invoice, this might look something like this:

Confirmation of receipt for an invalid e-invoice with validation report.

Confirmation of receipt for an invalid e-invoice with validation report.This automatically informs the sender that the e-invoice sent is invalid and must be rejected. The sender also receives the validation report in the email and can therefore understand why the recipient must reject the invoice.

The text in the forwarded emails and receipt confirmations sent in this way differs depending on the case:

- Invoice is not an e-invoice

- Invoice is a valid e-invoice

- Invoice is an invalid e-invoice

Receipt confirmations can also be enabled or disabled for each case.

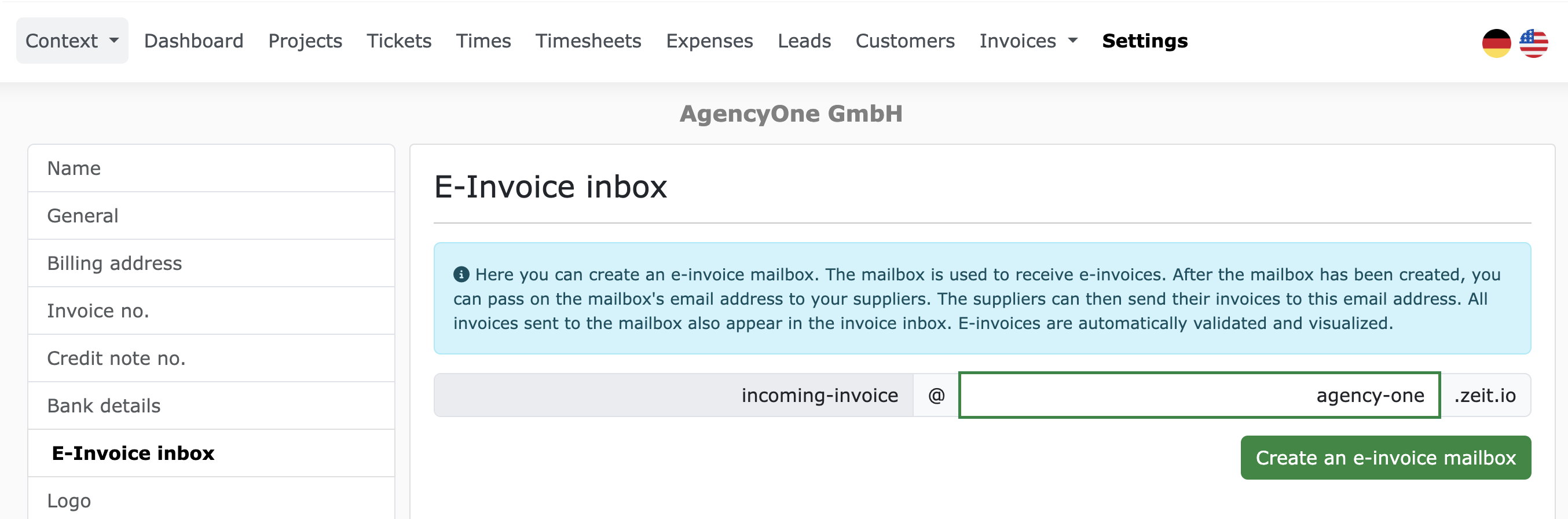

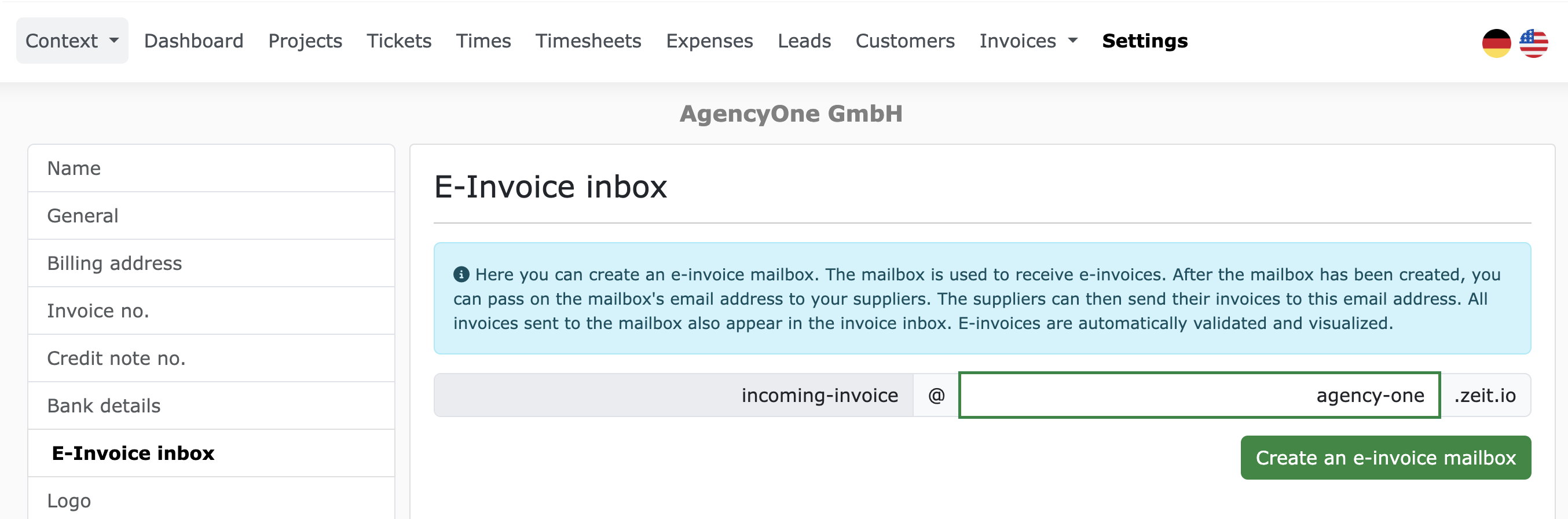

How can I create an e-invoice mailbox?

The e-invoice mailbox can be created and configured in the settings. For a ZEIT.IO organization, navigate to "Settings" in the main menu and then to "E-invoice mailbox." The form looks like this:

Create a new e-invoice mailbox

Create a new e-invoice mailbox

You can choose a subdomain of ZEIT.IO for the address. Ideally, this should be your company name. If you click the "Create e-invoice mailbox" button, the mailbox will be created immediately and is ready for use!

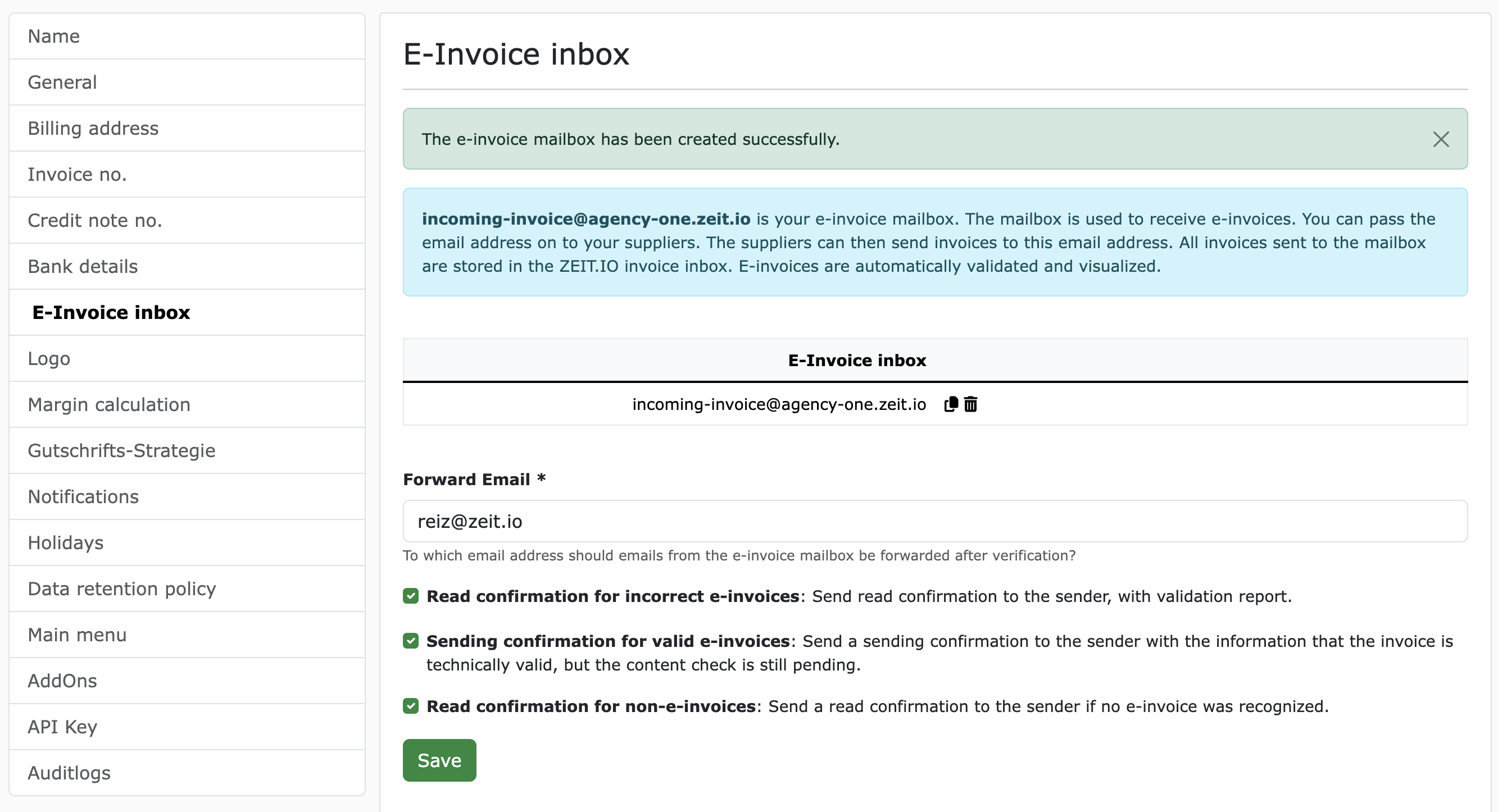

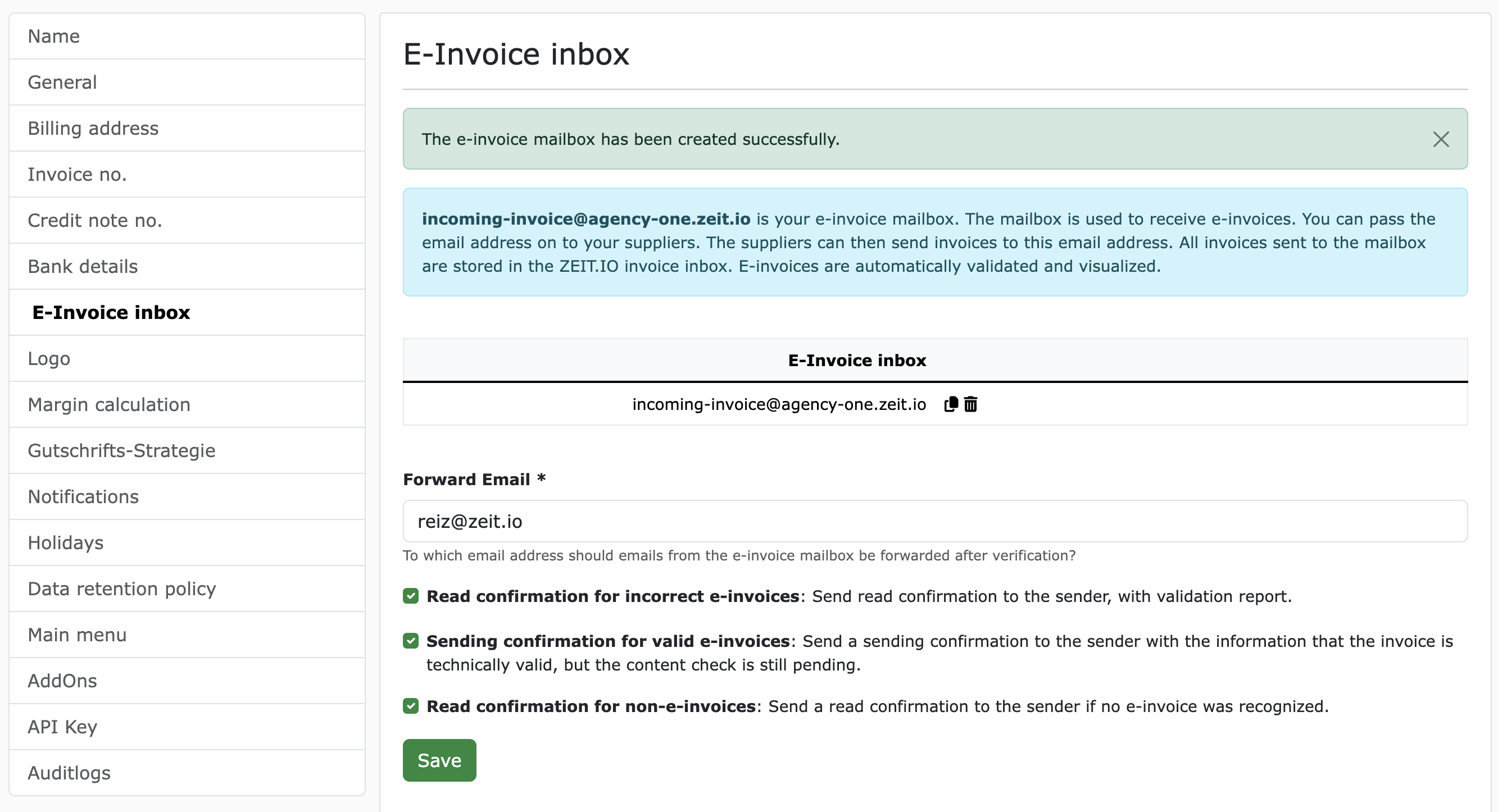

Configure your e-invoice mailbox at ZEIT.IO

Configure your e-invoice mailbox at ZEIT.IO

After creating the e-invoice mailbox, you can also specify a forwarding email address. This is the email address to which incoming messages will be forwarded. You can also configure the cases in which a confirmation of receipt should be sent.

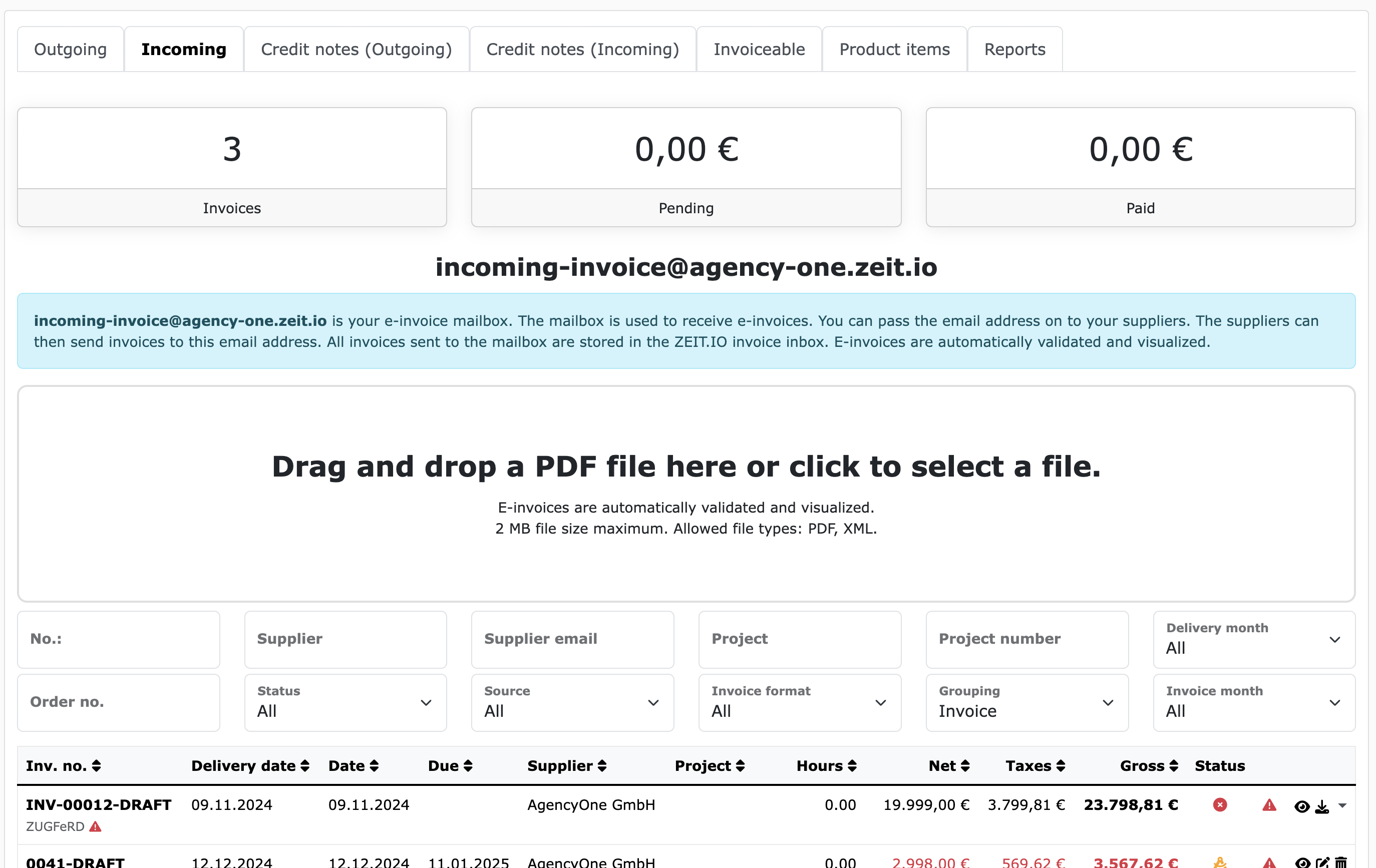

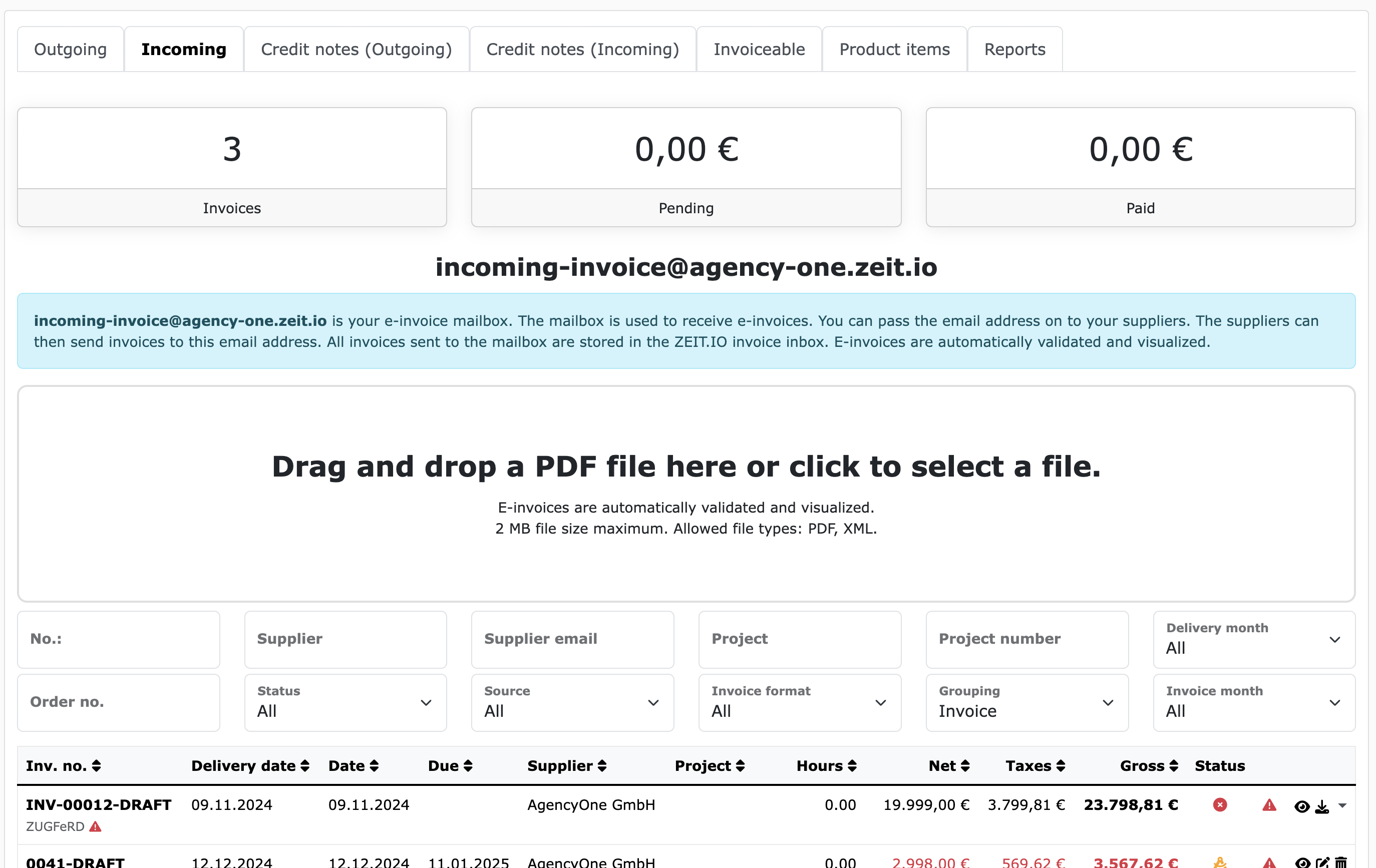

If you navigate to the invoice inbox, the address of the e-invoice mailbox will also appear there. You can now give this email address to your suppliers and inform them that they should please send future invoices to this address.

Invoice receipt with e-invoice mailbox service

Invoice receipt with e-invoice mailbox service

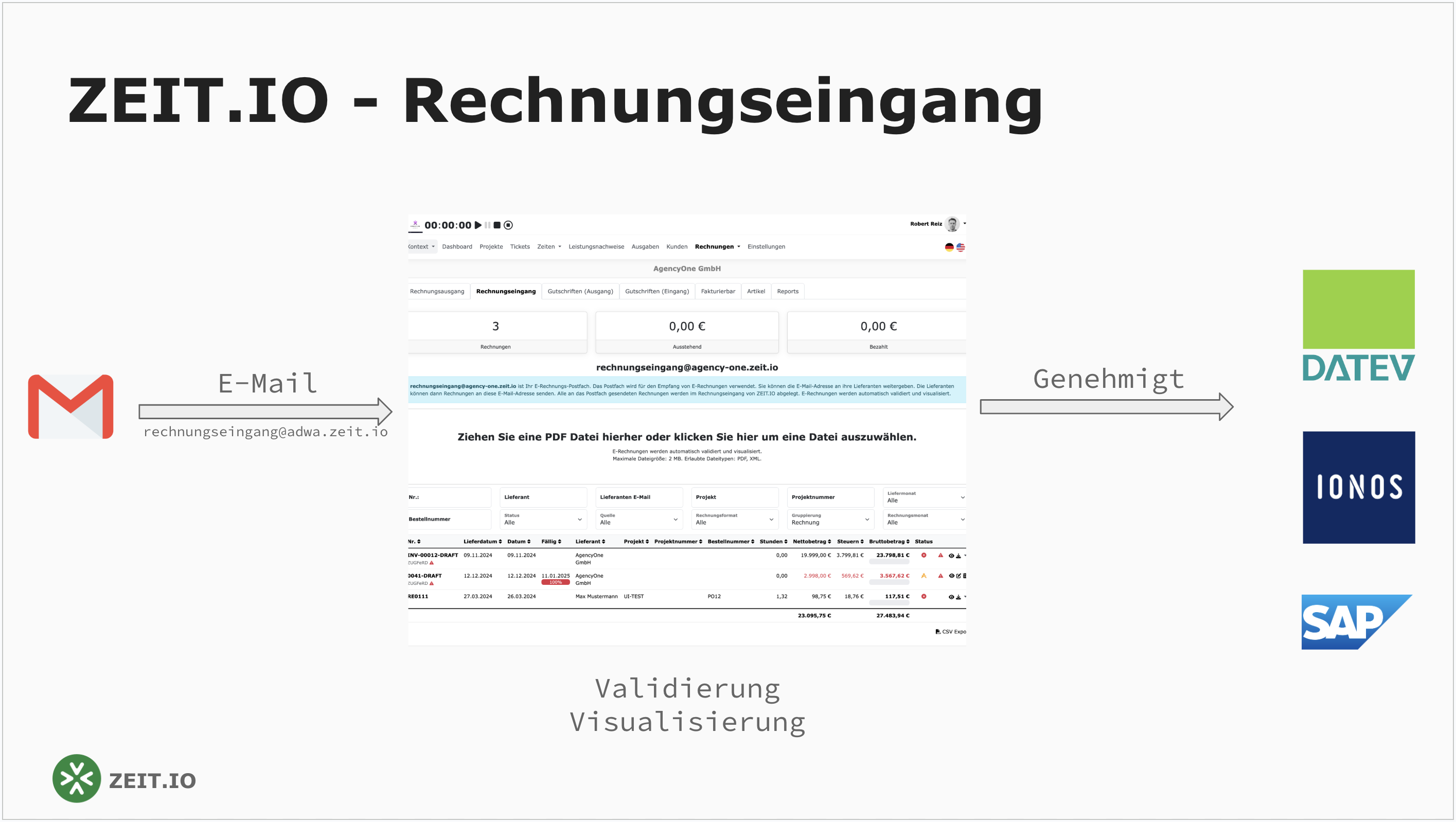

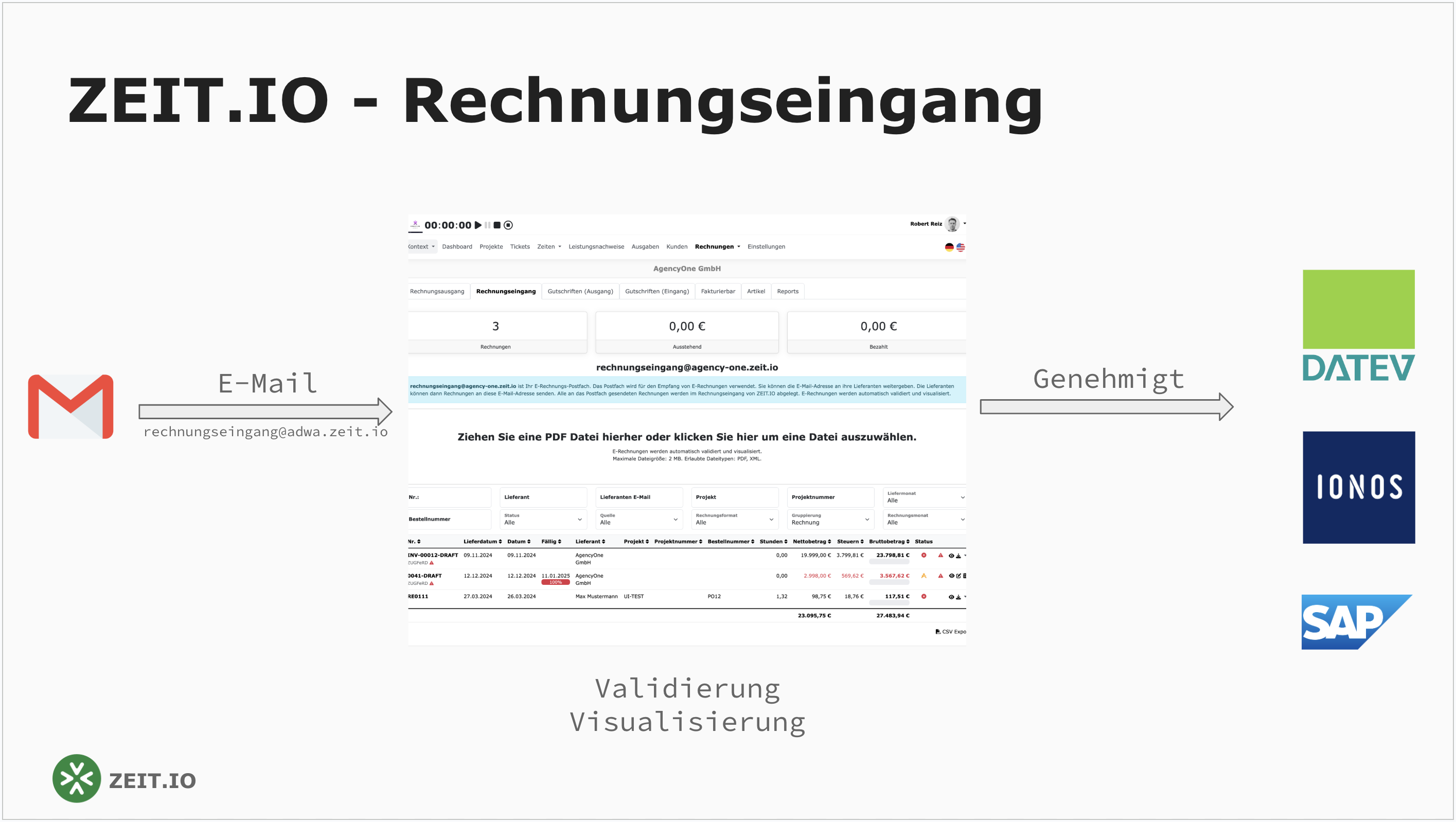

All invoices sent to your e-invoice inbox land here in the Invoice Inbox. There's also an approval process for incoming invoices here. All invoices in the Invoice Inbox can be commented on, rejected, or approved. Approved incoming invoices are automatically transferred to preconfigured third-party systems, such as DATEV, IONOS, or SAP.

ZEIT.IO invoice receipt with approval process and forwarding to DATEV, SAP and Co.

ZEIT.IO invoice receipt with approval process and forwarding to DATEV, SAP and Co.

Typically, approved incoming invoices are forwarded to DATEV Unternehmen Online.

Approval rights can, of course, be assigned individually for each user. Typically, only selected users within the company have the right to approve or reject incoming invoices.

The e-invoice mailbox for freelancers can be created and configured in a similar way. The only difference is that freelancers cannot select a subdomain. They must choose a name before the @ symbol. Otherwise, the functionality is exactly the same.

Create a new e-invoice mailbox

Create a new e-invoice mailboxYou can choose a subdomain of ZEIT.IO for the address. Ideally, this should be your company name. If you click the "Create e-invoice mailbox" button, the mailbox will be created immediately and is ready for use!

Configure your e-invoice mailbox at ZEIT.IO

Configure your e-invoice mailbox at ZEIT.IOAfter creating the e-invoice mailbox, you can also specify a forwarding email address. This is the email address to which incoming messages will be forwarded. You can also configure the cases in which a confirmation of receipt should be sent.

If you navigate to the invoice inbox, the address of the e-invoice mailbox will also appear there. You can now give this email address to your suppliers and inform them that they should please send future invoices to this address.

Invoice receipt with e-invoice mailbox service

Invoice receipt with e-invoice mailbox serviceAll invoices sent to your e-invoice inbox land here in the Invoice Inbox. There's also an approval process for incoming invoices here. All invoices in the Invoice Inbox can be commented on, rejected, or approved. Approved incoming invoices are automatically transferred to preconfigured third-party systems, such as DATEV, IONOS, or SAP.

ZEIT.IO invoice receipt with approval process and forwarding to DATEV, SAP and Co.

ZEIT.IO invoice receipt with approval process and forwarding to DATEV, SAP and Co.Typically, approved incoming invoices are forwarded to DATEV Unternehmen Online.

Approval rights can, of course, be assigned individually for each user. Typically, only selected users within the company have the right to approve or reject incoming invoices.

The e-invoice mailbox for freelancers can be created and configured in a similar way. The only difference is that freelancers cannot select a subdomain. They must choose a name before the @ symbol. Otherwise, the functionality is exactly the same.

How much does the e-invoice mailbox cost?

The e-invoice mailbox is included in the current paid plan (€9/month) for freelancers. It is also included in the basic fee (€19/month) for business customers. Each incoming invoice exceeding the included quota will be charged €0.10.

Conclusion

With the introduction of e-invoicing in Germany on January 1, 2025, companies, freelancers, and sole proprietors are required to receive, validate, and archive electronic invoices in the EN 16931 format (ZUGFeRD, XRechnung, Peppol BIS Billing) in an audit-compliant manner. ZEIT.IO offers a comprehensive solution for this: The e-invoice mailbox enables the automated receipt, validation, and visualization of e-invoices. By integrating with existing email systems and providing a validation report and a graphical representation of the invoice data, ZEIT.IO facilitates compliance with legal requirements and optimizes the invoicing process.