Export XRechnung as ZUGFeRD PDF

Since DATEV Unternehmen Online cannot properly handle XML invoices, ZEIT.IO offers a conversion from XRechnung to ZUGFeRD PDF. This conversion also works automatically when using ZEIT.IO's DATEV interface.

E-invoicing has been mandatory in Germany since January 1, 2025! Companies, as well as freelancers and sole proprietors, must be able to receive, validate, and archive e-invoices. Starting this year, e-invoices can no longer be rejected, and the recipient also has no right to an alternative invoice. This applies at least to e-invoices that comply with the EU standard EN 16931. But which e-invoice formats are these exactly?

Which e-invoice formats are legally required in Germany?

The EU standard EN 16931 defines an EU-wide standard without a syntax. The EU standard EN 16931 has so-called CIUS (Core Invoice Usage Specification), which contains a specific syntax and both national and industry-specific details. In Germany, the following CIUS have been considered EN 16931-compliant since January 1, 2025:

- ZUGFeRD from version 2.0.1

- XRechnung from version 3.0.1

- Peppol BIS Billing from version 3.0

These three specific e-invoice formats comply with the EU standard, and all three must be able to be received. As a company or self-employed person, you must be able to receive, validate, and archive all three formats. If you receive an XRechnung or Peppol BIS Billing invoice from a supplier, you may not reject it, nor are you entitled to an alternative version! You are legally obligated to process the invoice!

What's the problem?

ZUGFeRD is a hybrid format, consisting of an XML file embedded in an A3 PDF. The recipient always has an image view with the PDF. However, the primary system is XML, and PDF viewers don't display it! XRechnung and Peppol BIS 3 are pure XML formats, without an image view. Without a viewer, the recipient can't do anything with them.

What's the solution?

The ZEIT.IO invoice inbox can, of course, process all three invoice formats. You can upload ZUGFeRD, XRechnung, and Peppol BIS 3 invoices to ZEIT.IO via drag & drop and receive a validation report and a visualization of the XML data within seconds. If you have opted for audit-compliant storage, ZEIT.IO will also store the documents in an audit-compliant manner.

DATEV Unternehmen Online

Most SMEs in Germany use DATEV Unternehmen Online (DUO) to provide their documents to their tax advisors. Both outgoing and incoming invoices are uploaded to DATEV Unternehmen Online. However, as of today (May 8, 2025), DATEV Unternehmen Online cannot handle XML uploads. If you upload an XRechnung or a Peppol BIS 3 invoice to DUO, DUO will convert it to a PDF containing the XML string. DUO simply generates data garbage without understanding the actual content of the XML. There is neither validation nor proper visualization. Hard to believe, but true! In concrete terms, this means that you cannot fulfill your legal obligations with DUO!

If you receive an XRechnung, you can validate and visualize it using the invoice receipt from ZEIT.IO. However, forwarding it to your tax advisor via DUO is somewhat problematic. Even if you upload the XML file to DUO, the tax advisor will not be able to do anything with it.

If you receive an XRechnung, you can validate and visualize it using the invoice receipt from ZEIT.IO. However, forwarding it to your tax advisor via DUO is somewhat problematic. Even if you upload the XML file to DUO, the tax advisor will not be able to do anything with it.

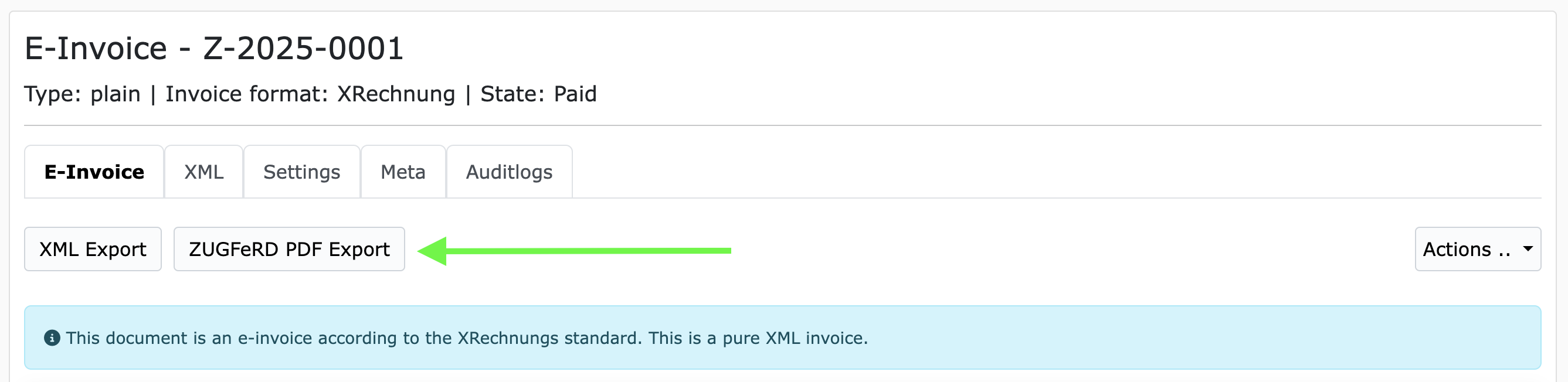

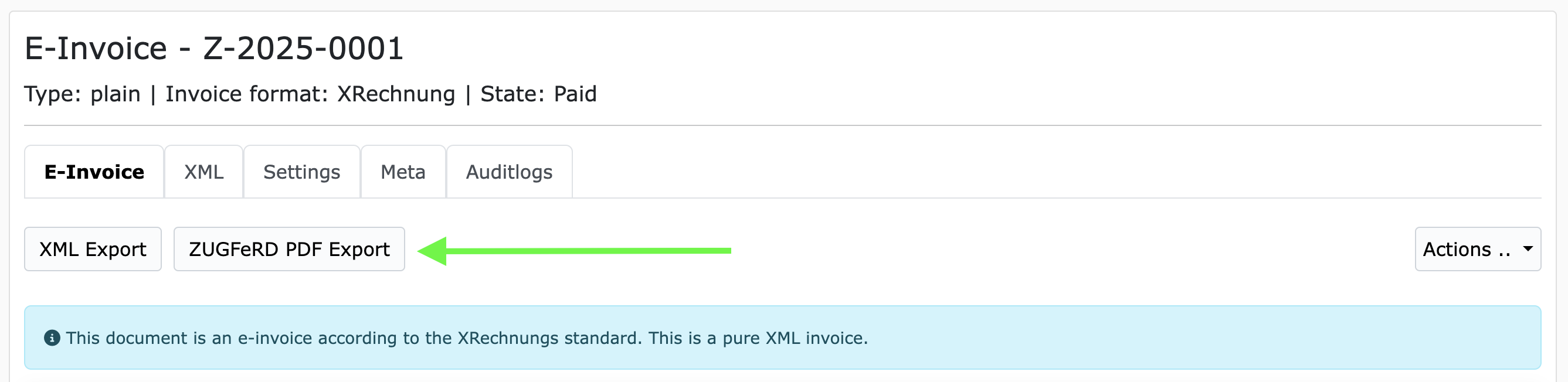

Converting an XRechnung to a ZUGFeRD PDF

Since DUO currently only supports PDF files, a workaround is needed. If you create an XRechnung on ZEIT.IO, you also have the option to export this e-invoice in ZUGFeRD format. The ZUGFeRD standard defines a total of six profiles, the sixth of which is XRechnung. If you export the XRechnung as a ZUGFeRD PDF on ZEIT.IO, ZEIT.IO creates a PDF image view for the invoice, and the original XRechnung XML is embedded in the PDF. This PDF file thus contains the full information content and the original invoice. You can then upload the PDF file to DATEV Unternehmen Online, and DUO can process it as usual.

Convert XRechnung to ZUGFeRD

Convert XRechnung to ZUGFeRD

By the way, if you use ZEIT.IO's DATEV interface, you don't have to do this step manually. ZEIT.IO uses the DATEV-DUM interface to transfer invoice documents to DATEV. If an XRechnung is to be transferred to DATEV, ZEIT.IO will automatically convert it into a ZUGFeRD invoice and then transmit this PDF to DATEV.

Convert XRechnung to ZUGFeRD

Convert XRechnung to ZUGFeRDBy the way, if you use ZEIT.IO's DATEV interface, you don't have to do this step manually. ZEIT.IO uses the DATEV-DUM interface to transfer invoice documents to DATEV. If an XRechnung is to be transferred to DATEV, ZEIT.IO will automatically convert it into a ZUGFeRD invoice and then transmit this PDF to DATEV.

Conclusion

E-invoicing will be mandatory in Germany starting in 2025. Companies must be able to receive, validate, and archive ZUGFeRD, XRechnung, and Peppol BIS. Since solutions like DATEV Unternehmen Online cannot properly handle XML invoices, ZEIT.IO's invoice module offers a legally compliant and practical solution with validation, visualization, archiving, and ZUGFeRD PDF export.