ZEIT.IO is a platform for the automatic billing of project times. Approved project times can be billed and credited automatically. The automatically created outgoing invoices and credit notes are valid e-invoices according to the ZUGFeRD standard.

From January 1st, 2025, companies in Germany must be able to receive e-invoices! From January 1st, 2025, companies, and even self-employed people, will no longer be allowed to reject an e-invoice. They must be able to receive e-invoices and thus validate them. But what exactly does that mean? And what exactly is an e-invoice according to the ZUGFeRD standard?

From January 1st, 2025, companies in Germany must be able to receive e-invoices! From January 1st, 2025, companies, and even self-employed people, will no longer be allowed to reject an e-invoice. They must be able to receive e-invoices and thus validate them. But what exactly does that mean? And what exactly is an e-invoice according to the ZUGFeRD standard?

What is an e-invoice according to the ZUGFeRD standard?

The EU wants to digitize and standardize invoices. There is the EU standard EN 16931 for this purpose. A concrete implementation of this EU standard is the ZUGFeRD standard. The ZUGFeRD standard describes an e-invoice as a hybrid invoice, consisting of a PDF file in which an XML file is embedded. The XML file is standardized and contains all relevant invoice data, such as sender, recipient, invoice items, tax rates and much more. It is important to know that with a ZUGFeRD invoice, the information in the XML file is what matters. Not the image view in the PDF! What counts is the information in the XML!

ZUGFeRD Logo

ZUGFeRD Logo

ZUGFeRD Logo

ZUGFeRD LogoVisualize

Since an e-invoice depends on the information in the XML file, it is also important that this information is visualized. Because an XML file is not particularly legible for people.

Validate

The obligation to validate exists independently of the e-invoice. If you as a company receive an invoice, you are obliged to check it for correctness. A normal invoice has a handful of attributes that must be checked, such as sequential invoice number, invoice date, delivery date, and so on. An e-invoice can contain several hundred attributes that must be checked. For example, you must check whether the XML file is valid and has complied with all of CII's syntax rules. Of course, you no longer do this manually. For this you definitely need software that carries out the validation and tells you whether the document is valid or not.

How does this work in ZEIT.IO?

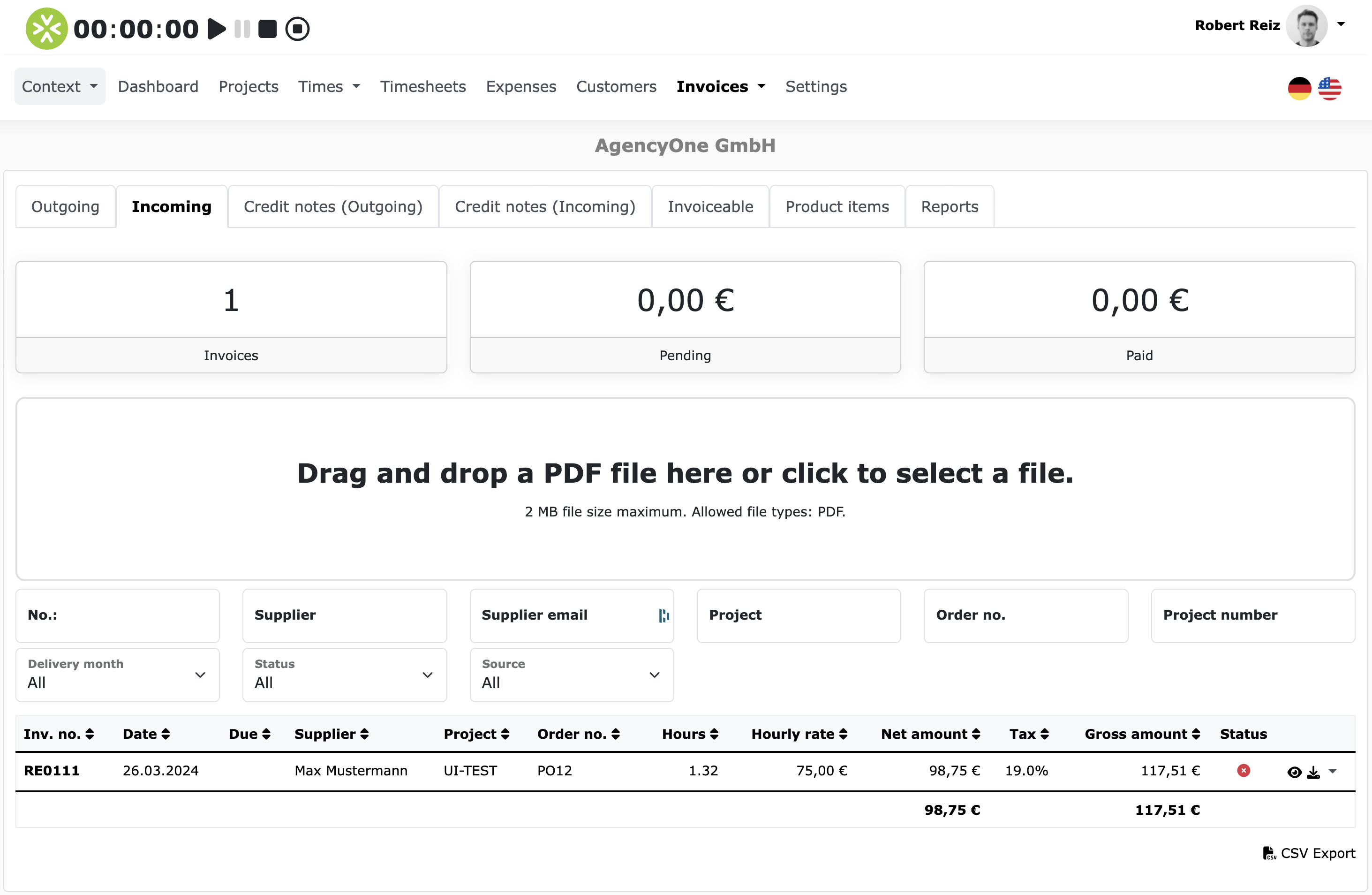

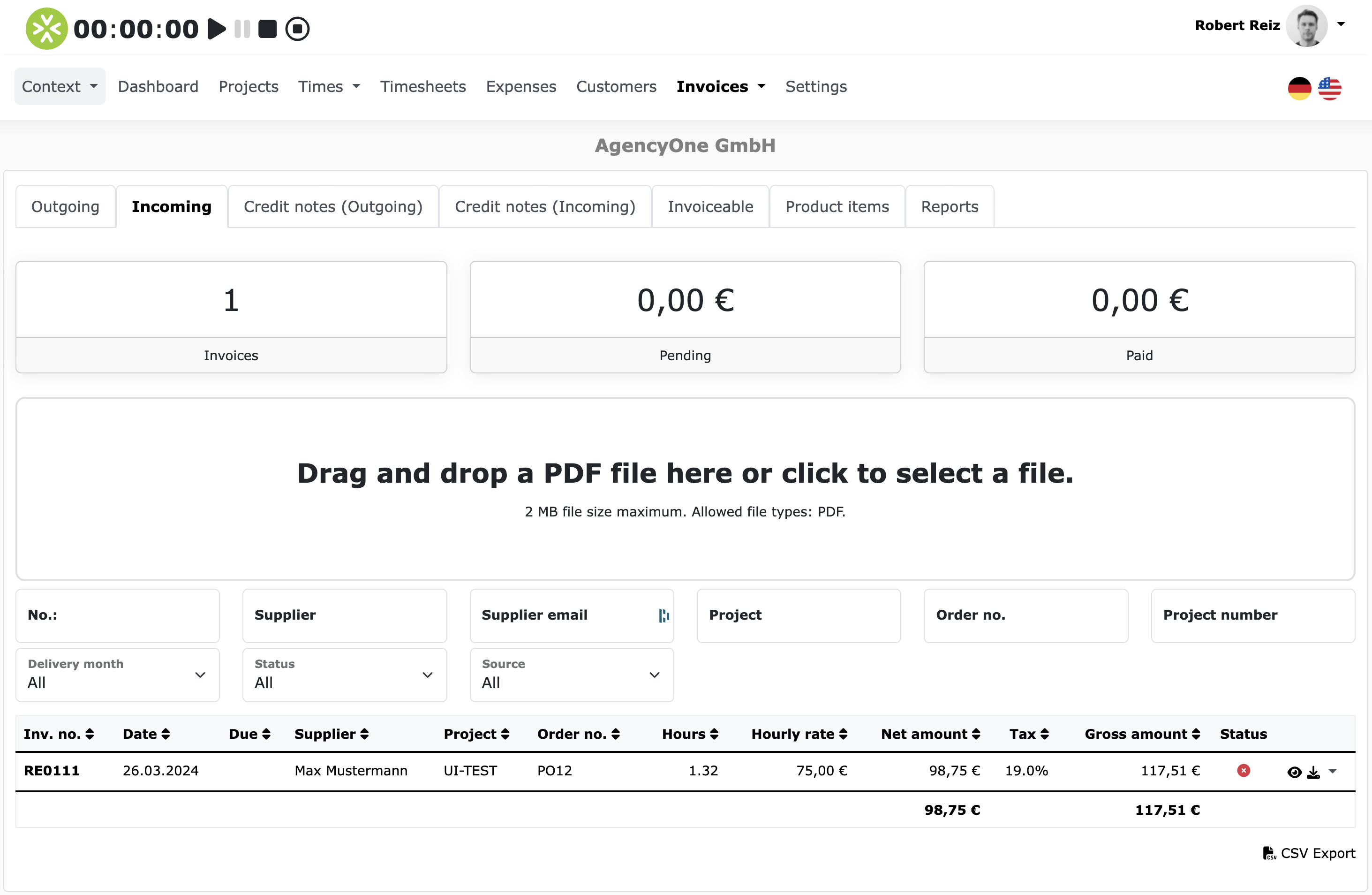

As an organization on ZEIT.IO, you naturally also have an invoice inbox there. You can drag and drop a file onto the invoice inbox and it will then be uploaded and checked.

ZEIT.IO incoming invoices

ZEIT.IO incoming invoices

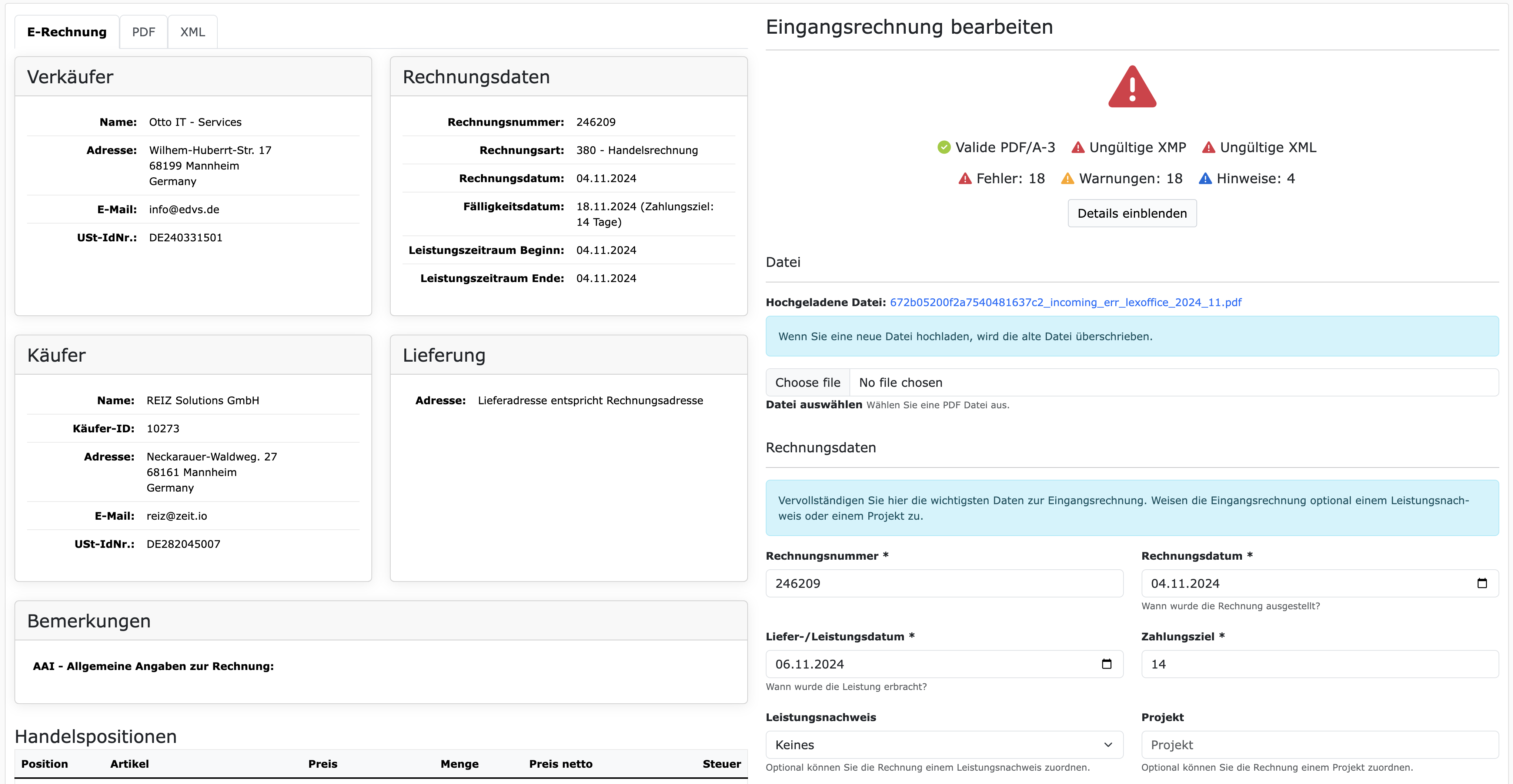

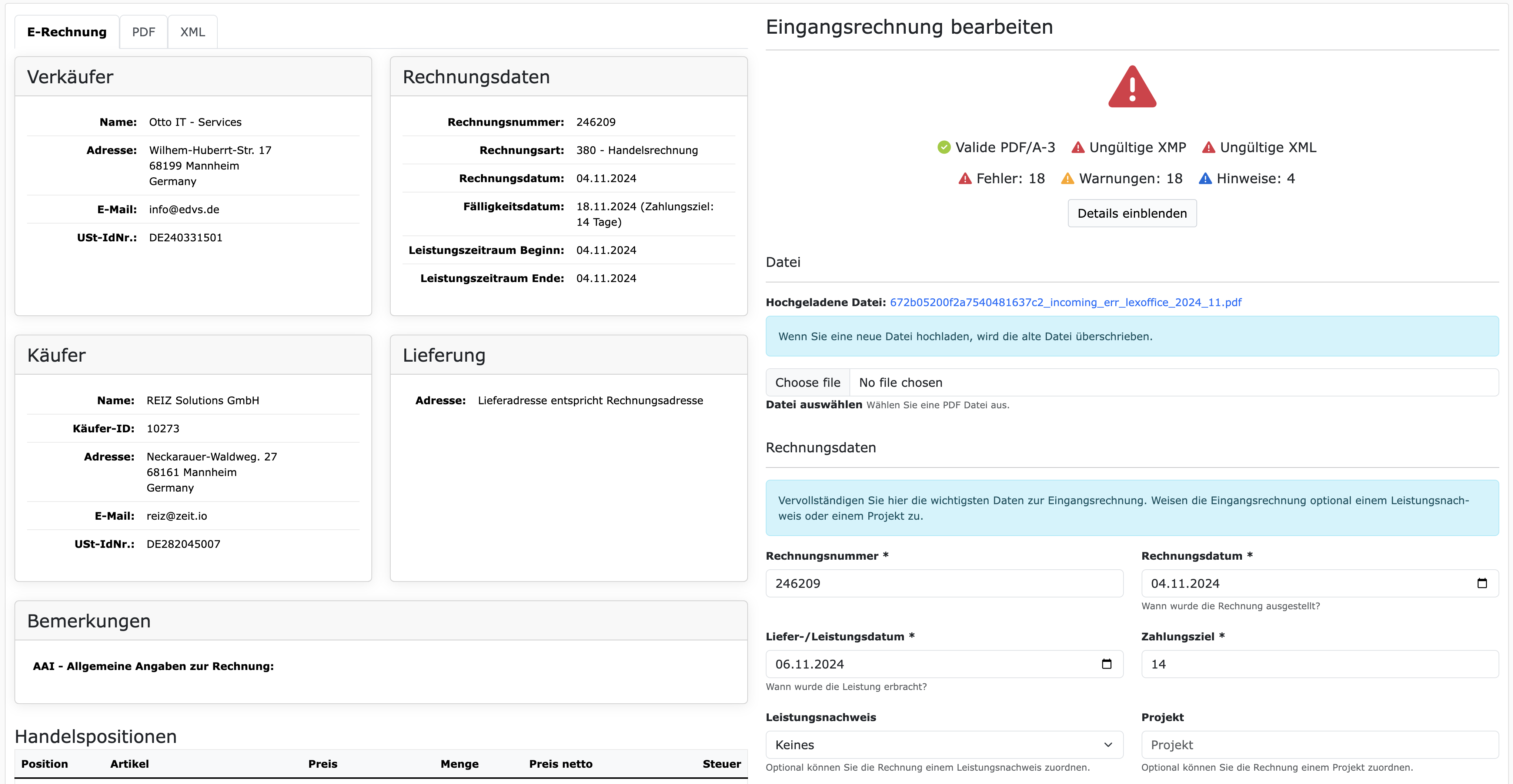

After uploading, you will be redirected to a split-view page. The uploaded document is displayed on the left side and the validation results and a form to complete data are displayed on the right side.

Validation results of an invalid ZUGFeRD document

Validation results of an invalid ZUGFeRD document

In the image above, you can see that the uploaded file is a ZUGFeRD file. And since ZUGFeRD depends on the contents of the XML, the visualized XML is shown on the left. You can also switch to the PDF image view using the tabs on the top left, but this is not crucial. And you can also switch to the XML view, but this is very difficult for people to understand.

On the right side we can see that this is not a valid e-invoice. The XML file embedded in the PDF is not valid. A total of 18 errors were found, 18 warnings and there are 4 notes. You can also view the individual errors, warnings and notes by clicking on the "Show details" button. In any case, an invoice with so many errors should be rejected!

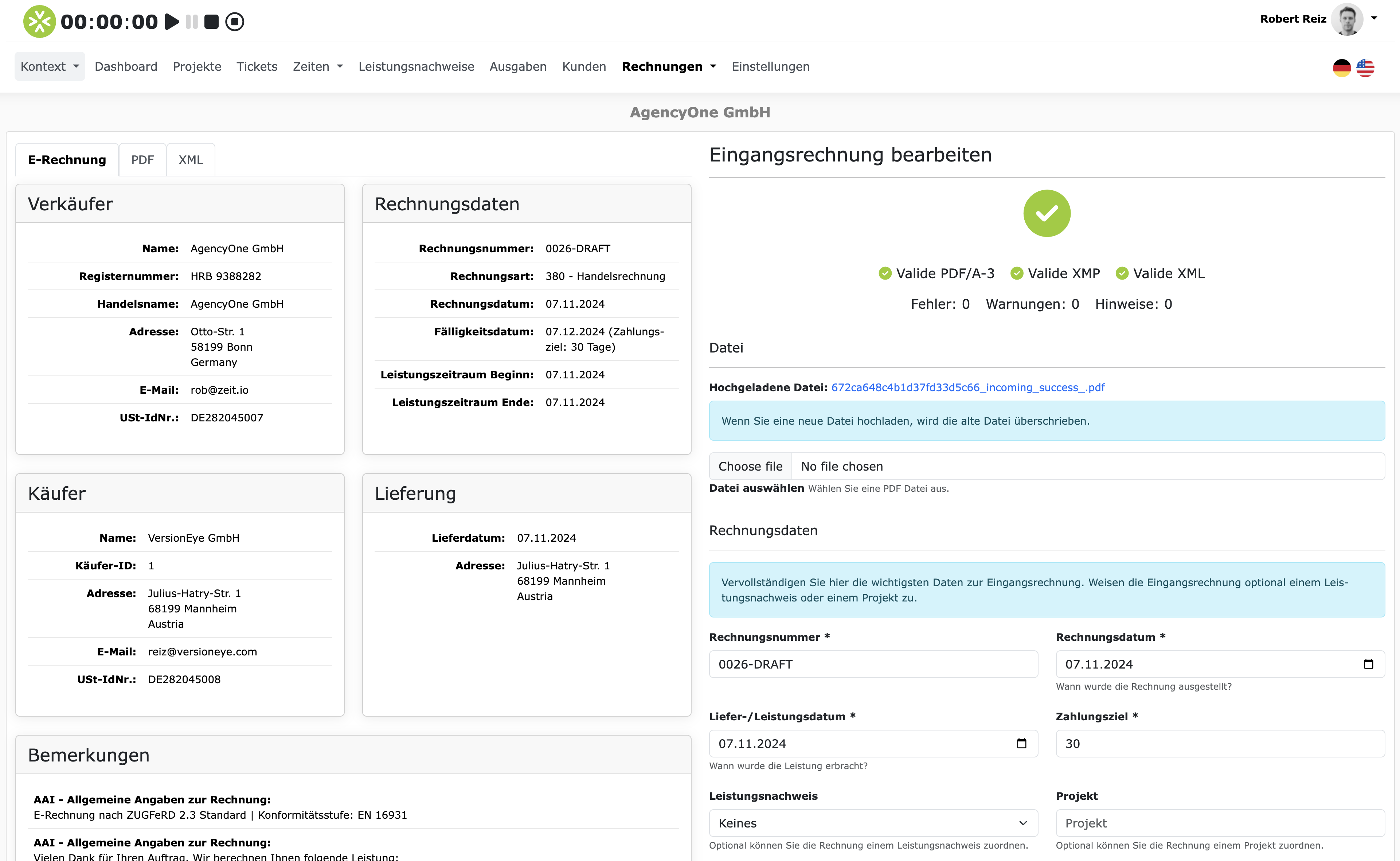

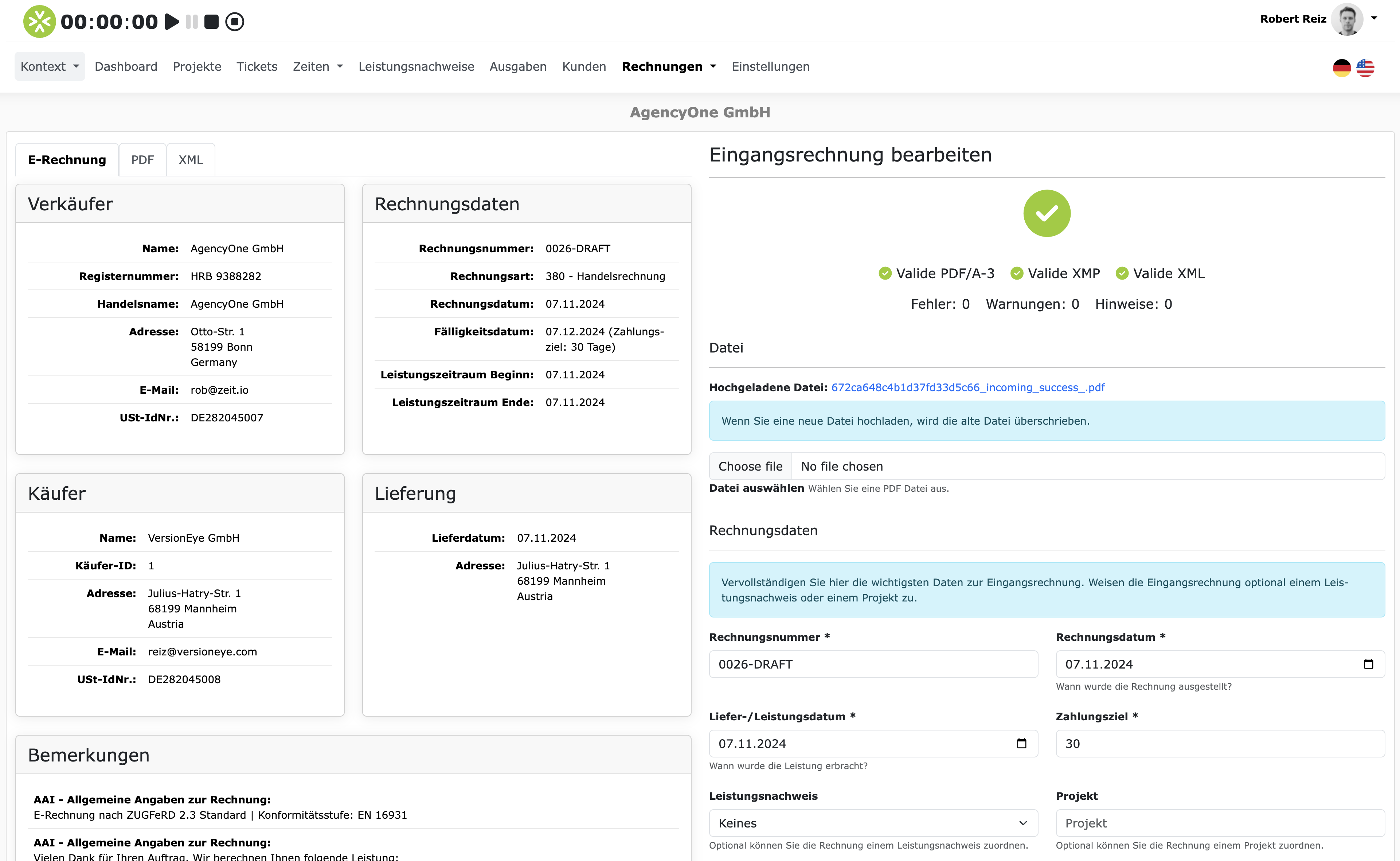

Here is another example with a valid ZUGFeRD file.

Validation results of an valid ZUGFeRD document

Validation results of an valid ZUGFeRD document

In the screenshot above you can see the validation results of a valid ZUGFeRD file. If you see a large green check mark in the top right-hand part, then the file is at least technically correct! Of course, you still have to check the content of the visualized XML and decide whether you want to pay the invoice or not.

ZEIT.IO incoming invoices

ZEIT.IO incoming invoicesAfter uploading, you will be redirected to a split-view page. The uploaded document is displayed on the left side and the validation results and a form to complete data are displayed on the right side.

Validation results of an invalid ZUGFeRD document

Validation results of an invalid ZUGFeRD documentIn the image above, you can see that the uploaded file is a ZUGFeRD file. And since ZUGFeRD depends on the contents of the XML, the visualized XML is shown on the left. You can also switch to the PDF image view using the tabs on the top left, but this is not crucial. And you can also switch to the XML view, but this is very difficult for people to understand.

On the right side we can see that this is not a valid e-invoice. The XML file embedded in the PDF is not valid. A total of 18 errors were found, 18 warnings and there are 4 notes. You can also view the individual errors, warnings and notes by clicking on the "Show details" button. In any case, an invoice with so many errors should be rejected!

Here is another example with a valid ZUGFeRD file.

Validation results of an valid ZUGFeRD document

Validation results of an valid ZUGFeRD documentIn the screenshot above you can see the validation results of a valid ZUGFeRD file. If you see a large green check mark in the top right-hand part, then the file is at least technically correct! Of course, you still have to check the content of the visualized XML and decide whether you want to pay the invoice or not.

Conclusion

On ZEIT.IO you can now not only create valid e-invoices according to ZUGFeRD, but also receive, validate and visualize ZUGFeRD documents from suppliers. With ZEIT.IO you are therefore very well prepared for the e-invoicing requirement that will come in 2025!