Freelance experts sell their time for money. They track the time they have worked for the customer and bill the customer for this. Usually there is an approval process involved and if the customer has approved the booked times, it can be billed. For most customers, this cycle repeats itself every month. Some customers even run this cycle on a weekly basis.

In any case, freelance experts have to issue invoices on a regular basis. A proper invoice must be drawn up that is valid before the tax office. This includes, among other things:

In any case, freelance experts have to issue invoices on a regular basis. A proper invoice must be drawn up that is valid before the tax office. This includes, among other things:

- A consecutive invoice number

- Delivery date

- Date of invoice

- The reporting of taxes

- List of hours worked with hourly wages

- Ideally, an approved proof of performance should be attached to the invoice

The creation of such an invoice can take a few minutes. An annoying activity that you have to repeat every month if you want money.

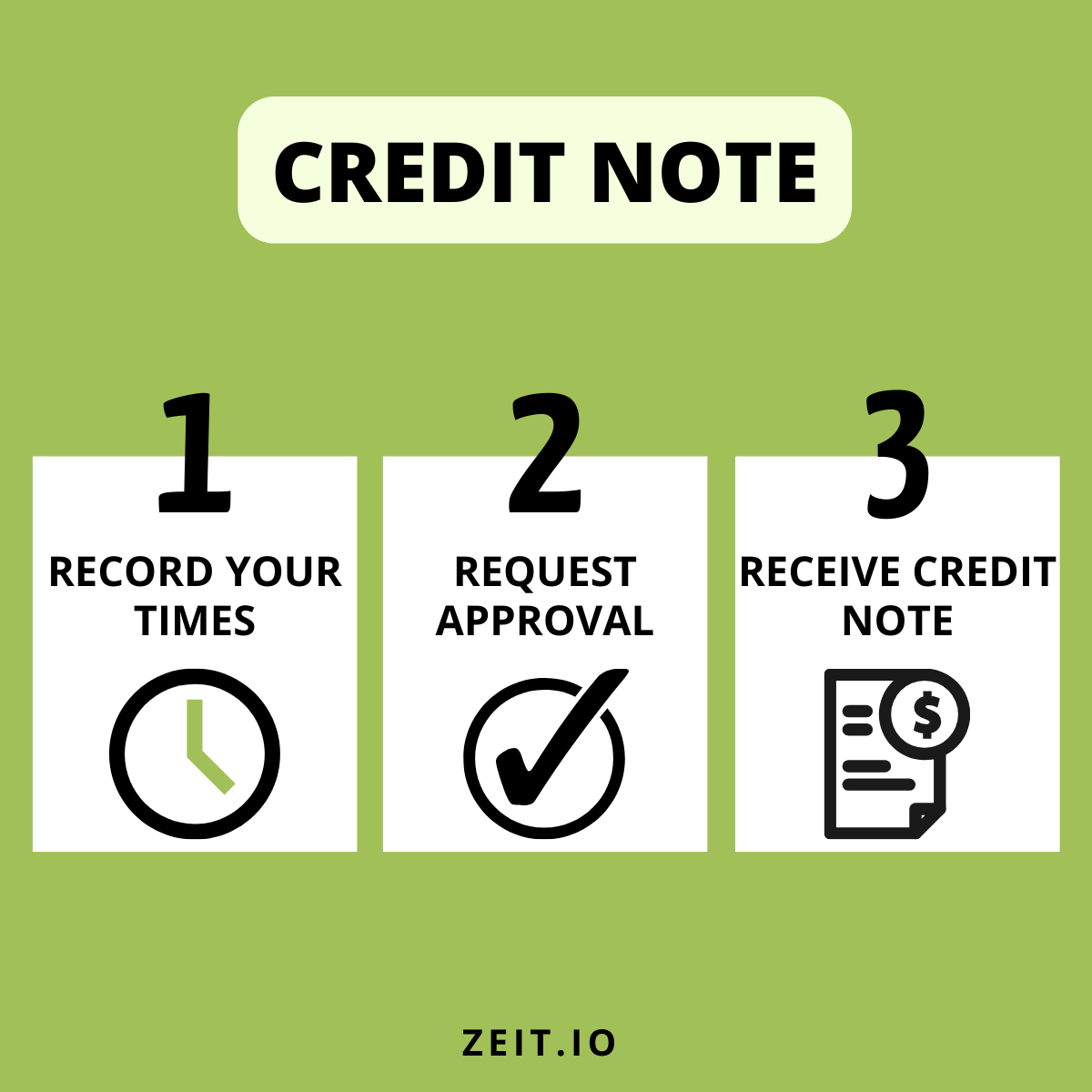

ZEIT.IO now optionally offers a credit memo procedure. A credit is a reverse invoice and is always issued by the customer. Experts who receive a credit do not have to issue an invoice! Anyone who takes part in the credit note procedure automatically receives a credit note as soon as the timesheet has been approved. This means that there is no need to issue an invoice. That saves a lot of time that can be spent for other more enjoyable activities.

ZEIT.IO Credit Procedure

ZEIT.IO Credit ProcedureCredit memo procedure from the point of view of the expert

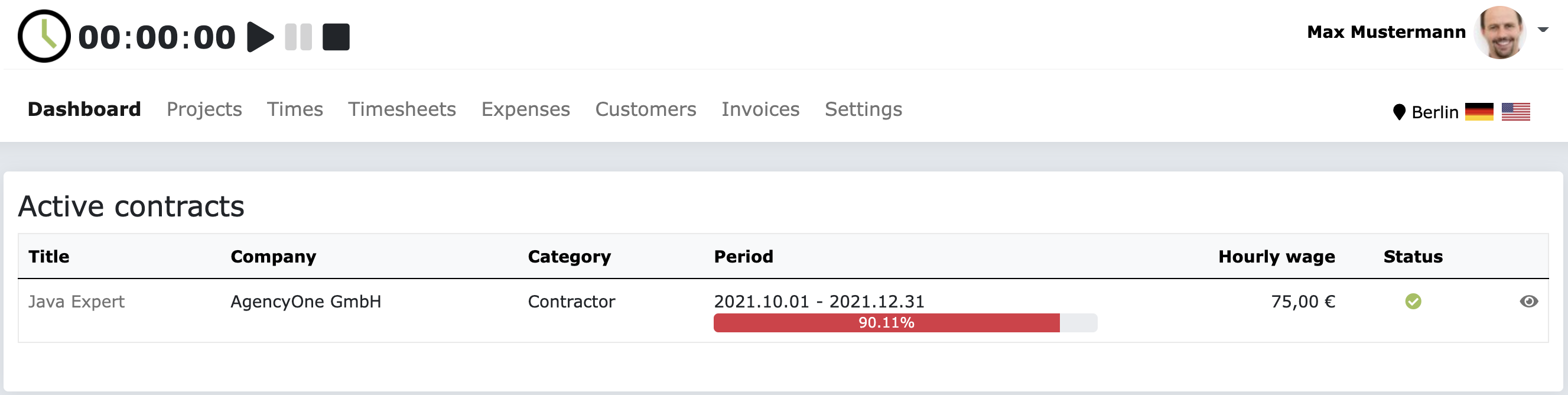

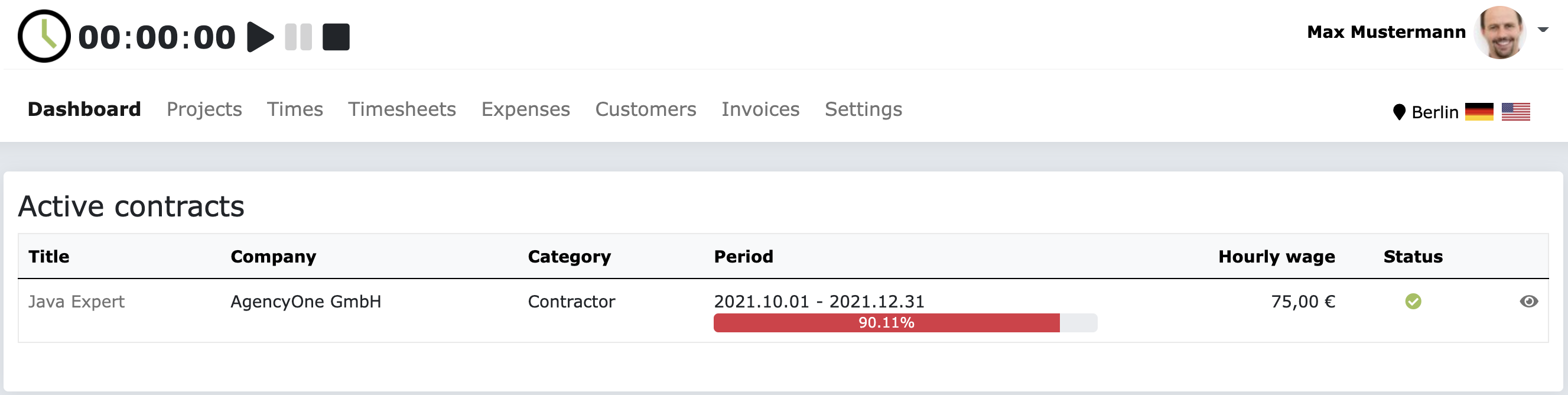

The credit memo procedure for experts can be activated as follows. If you are logged in to ZEIT.IO as an expert, then navigate to your contract. As shown in the example here.

Active contracts at ZEIT.IO

Active contracts at ZEIT.IO

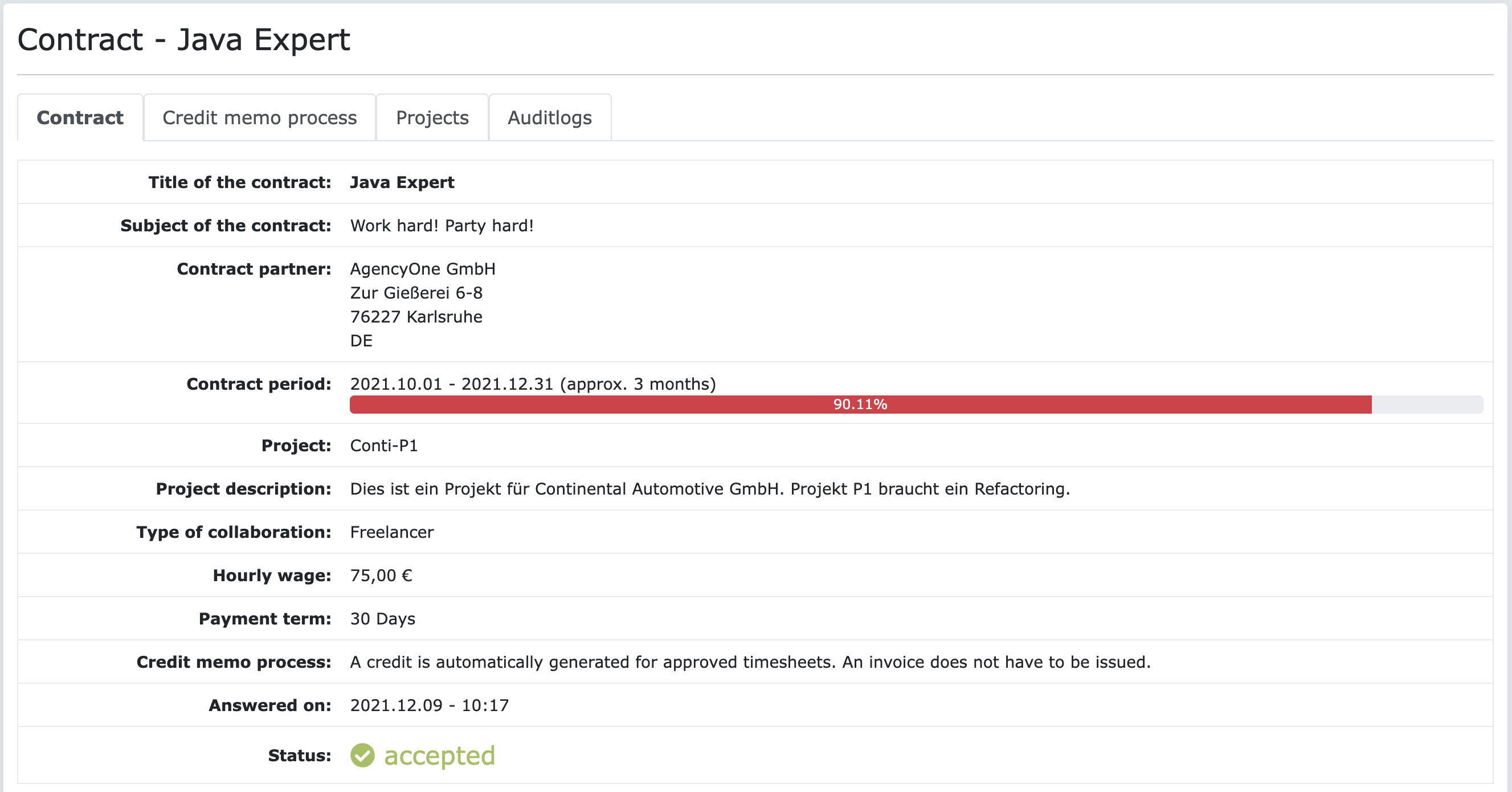

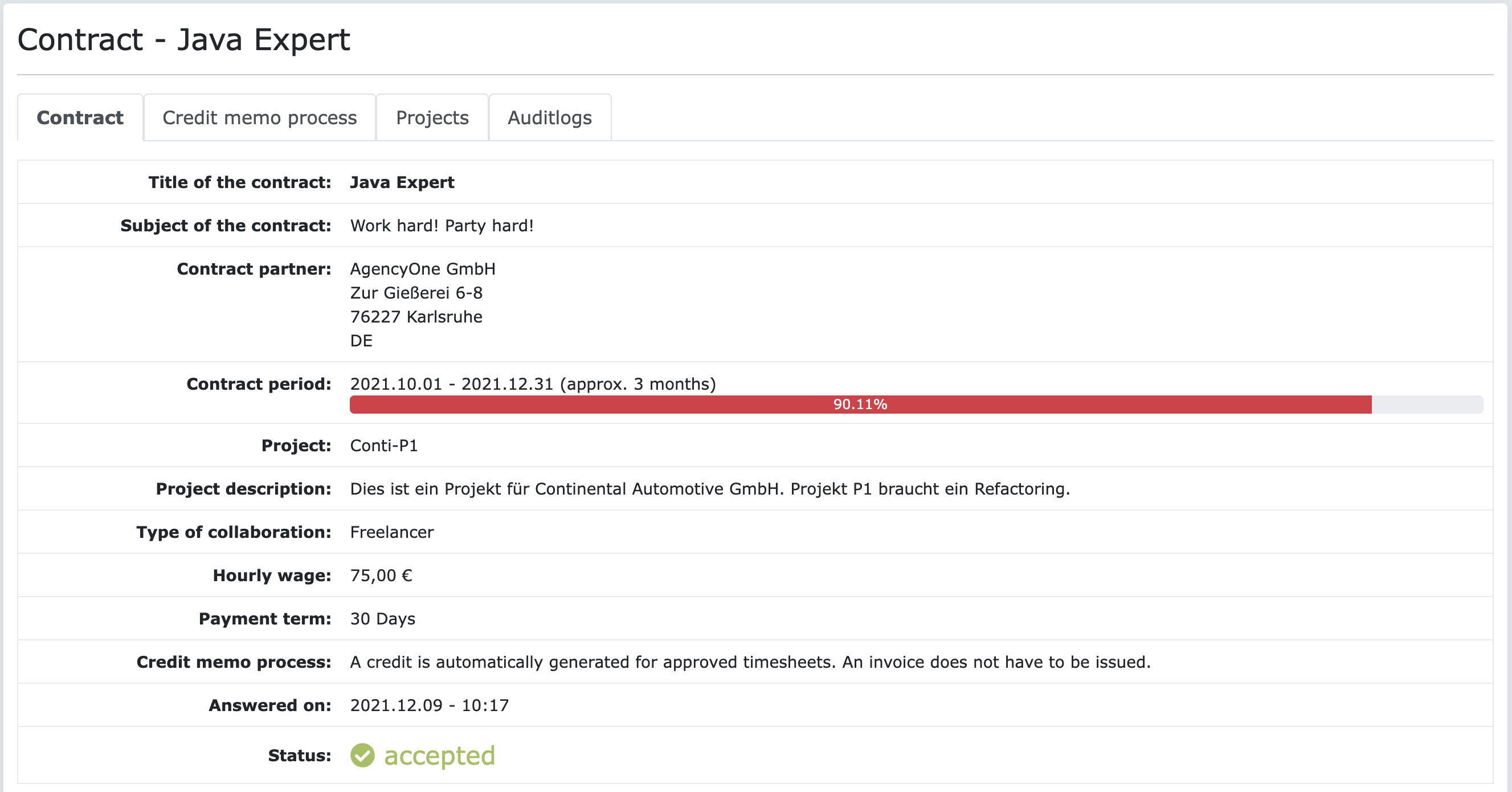

In the detailed view you can see the most important key data of your contract.

Contract at ZEIT.IO

Contract at ZEIT.IO

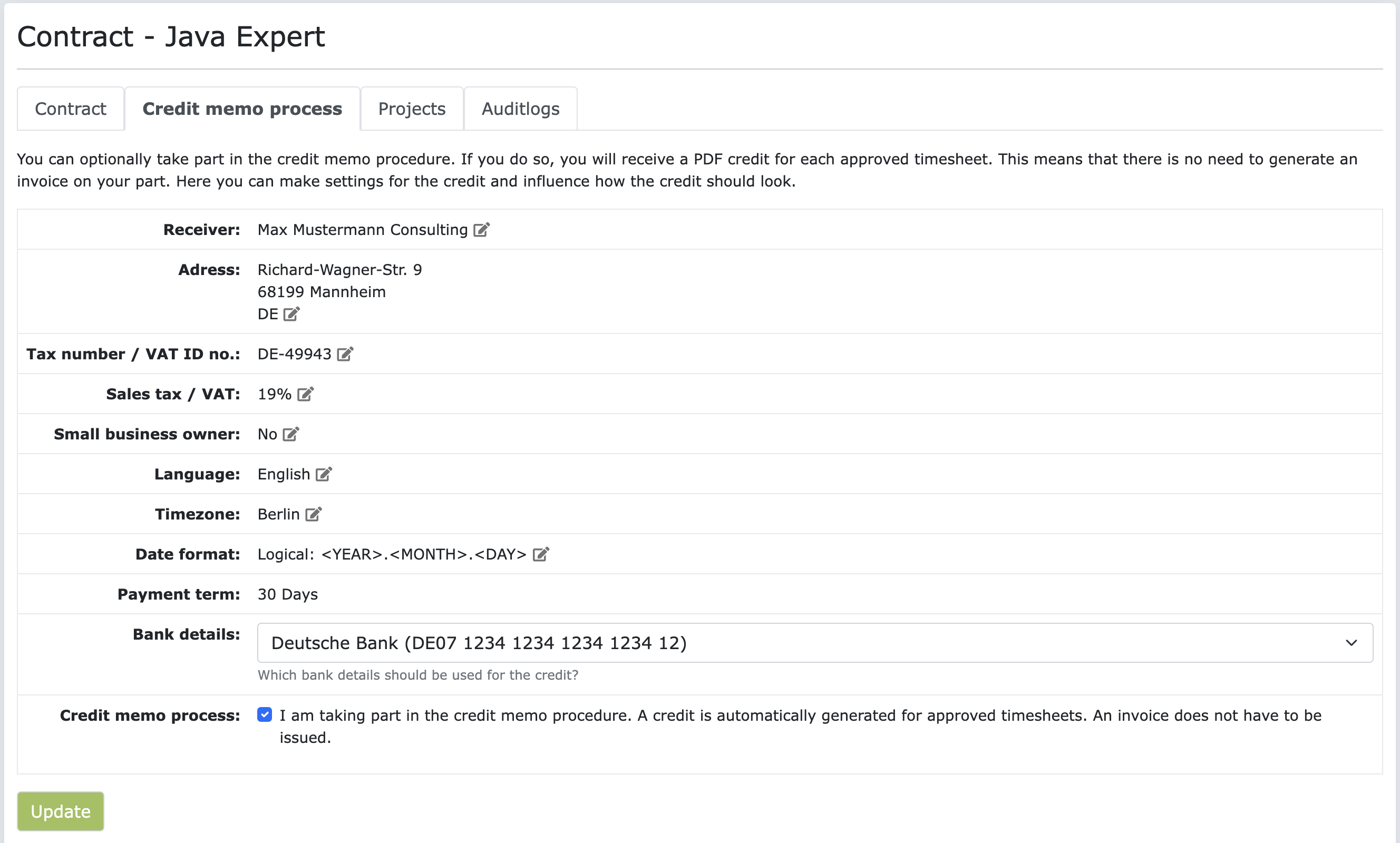

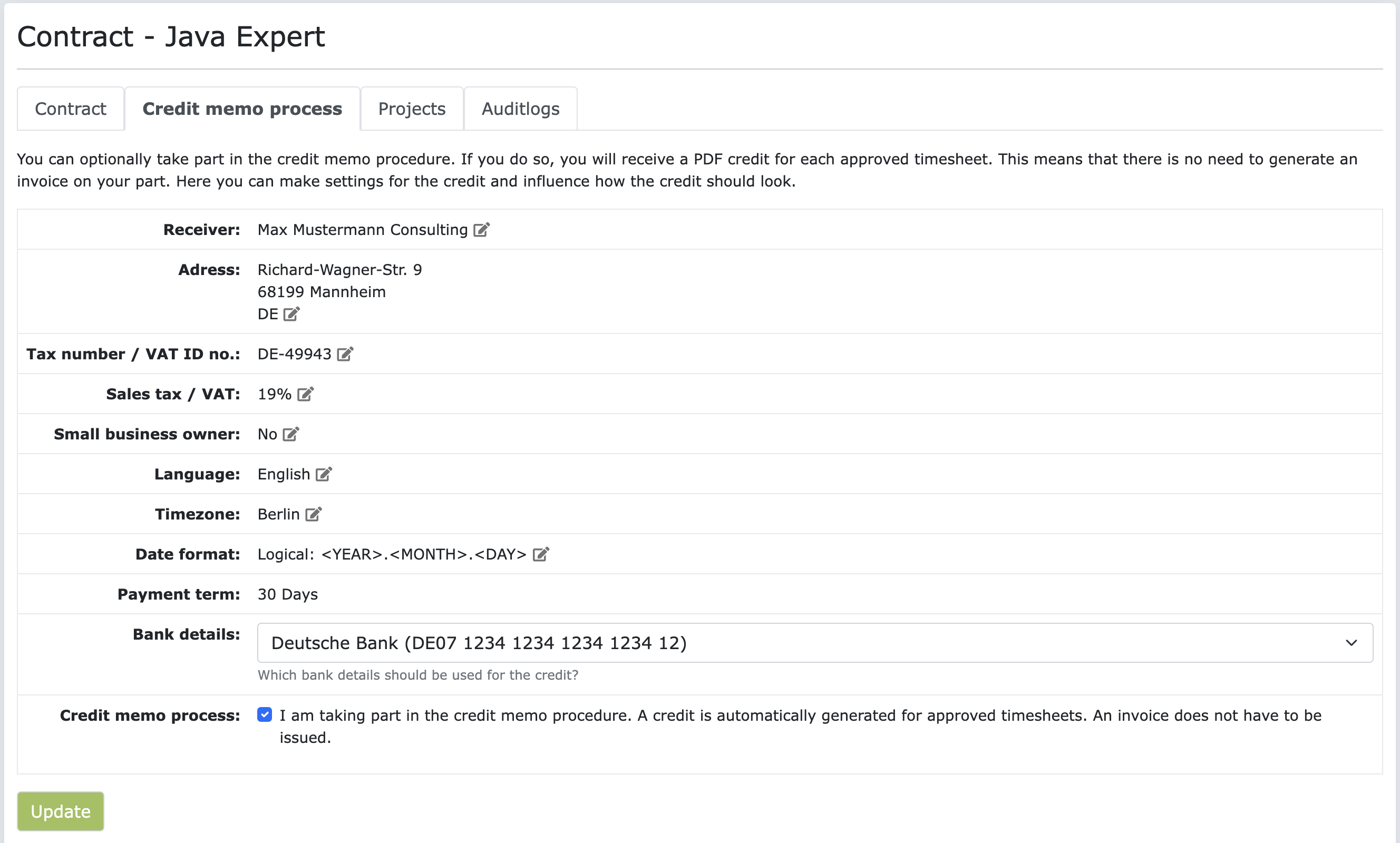

At the top left there is a tab for the credit memo procedure.

Credit memo procedure at ZEIT.IO

Credit memo procedure at ZEIT.IO

In this tab you can generally decide whether you want to take part in the credit memo procedure. If that is the case, check the box at the bottom and click the Update button. You can also use this tab to influence how the credit should look like. Here you can configure your name, recipient address, tax number, VAT rate, language, time zone, date format and bank details. These settings are taken into account when the credit is generated.

When the credit memo procedure is activated, you don't have to do much more. All you have to do is apply for a permit for the times you have booked. The approval process runs via a so-called timesheet. Once the timesheet has been approved, a credit will automatically be generated for you. You will receive the credit in PDF format via email. You can also see all of your credits on ZEIT.IO under "Invoices -> Credits notes".

Here is a short 5 minute YouTube video that shows the activation from an expert's point of view.

Active contracts at ZEIT.IO

Active contracts at ZEIT.IOIn the detailed view you can see the most important key data of your contract.

Contract at ZEIT.IO

Contract at ZEIT.IOAt the top left there is a tab for the credit memo procedure.

Credit memo procedure at ZEIT.IO

Credit memo procedure at ZEIT.IOIn this tab you can generally decide whether you want to take part in the credit memo procedure. If that is the case, check the box at the bottom and click the Update button. You can also use this tab to influence how the credit should look like. Here you can configure your name, recipient address, tax number, VAT rate, language, time zone, date format and bank details. These settings are taken into account when the credit is generated.

When the credit memo procedure is activated, you don't have to do much more. All you have to do is apply for a permit for the times you have booked. The approval process runs via a so-called timesheet. Once the timesheet has been approved, a credit will automatically be generated for you. You will receive the credit in PDF format via email. You can also see all of your credits on ZEIT.IO under "Invoices -> Credits notes".

Here is a short 5 minute YouTube video that shows the activation from an expert's point of view.

Credit memo procedure from the agency's point of view

From the agency's point of view, invoices from experts are often associated with problems. These problems often arise:

- The expert's invoice is incorrect. Common mistakes are:

- The invoice number was forgotten to count up.

- The delivery date is wrong.

- The invoice date is from the previous month.

- Taxes were not reported correctly.

- The number of hours worked is incorrectly stated.

- The invoice format is wrong and is not recognised by the tax office.

- The expert sometimes takes several weeks, or even months, to prepare his calculations. In this case, the agency has to set up provisions.

In such cases, the agency must contact the expert and ask for a corrected invoice. This takes a lot of time and energy. All these problems can be avoided very elegantly with the credit note procedure. The credit memo procedure offers the following advantages for the agency:

- The credit note has a neat format that contains all the necessary information. In any case, it is in a format that is recognized by the tax office.

- As an agency, you don't have to wait for the expert to issue his invoice.

- The credit is immediately in the system and is automatically synchronized after receipt of the DATEV invoice.

As an agency, when setting up the contract for the expert, you can configure whether you generally offer credits. And you can optionally save 2 discounts. The expert can then optionally take part in the credit memo procedure and also decide whether the credit should be generated with or without a discount.

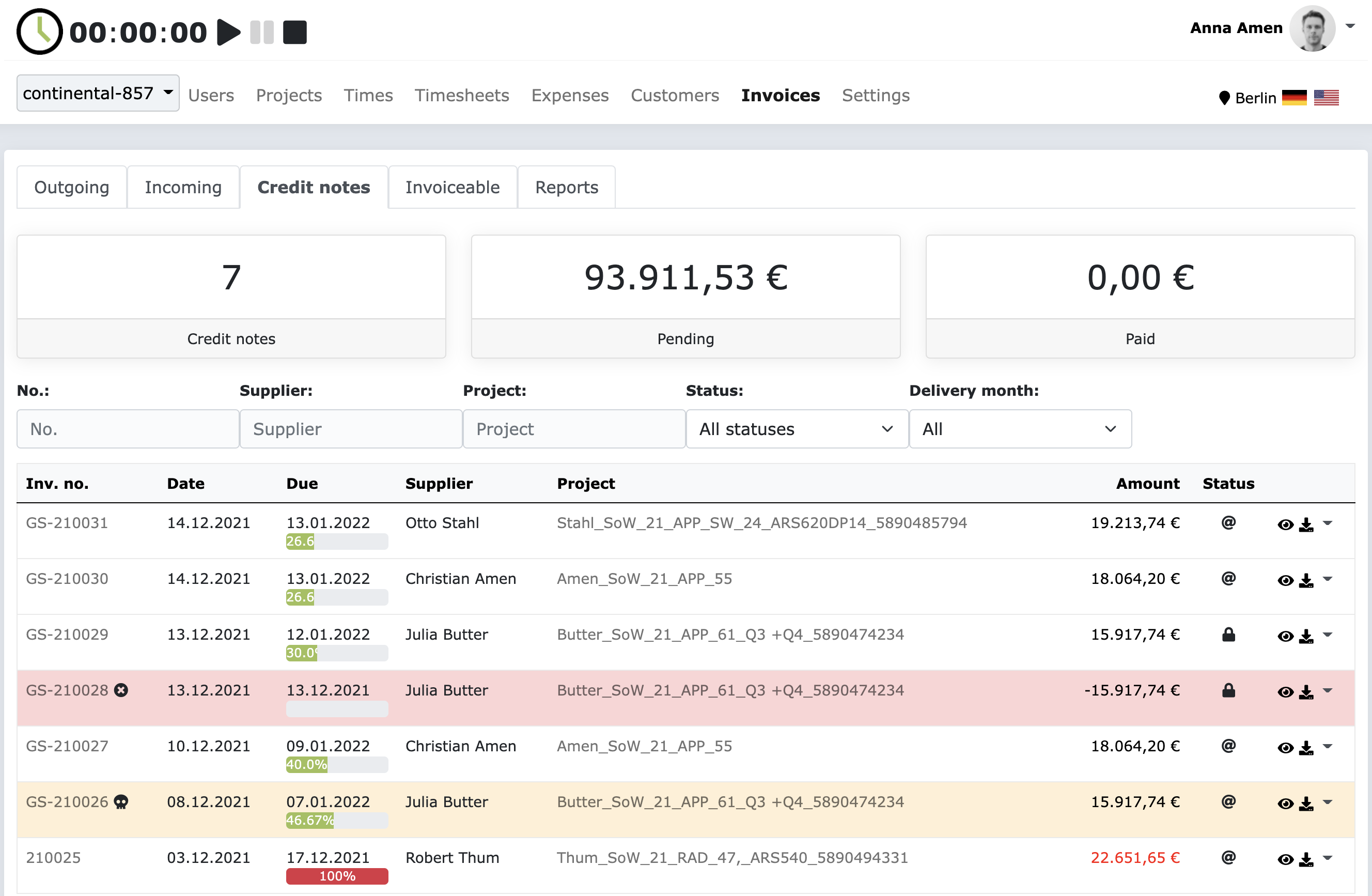

As an agency, you can see all credits under "Invoices - Credit notes". Here's an example:

Credit notes on ZEIT.IO

Credit notes on ZEIT.IOIf a credit note is incorrect, there is of course the option of canceling it. Otherwise, each credit can be marked as "In Process" or "Paid". that way as an agency, you always have an overview of your credits. And of course there are plenty of search and filter functions.

If your ZEIT.IO organization is connected to a DATEV account, all created credits are automatically synced to DATEV. This sync works fully automatically and in real time.

The credit note process is a win-win situation for both parties. Both the expert and the agency benefit from it. Both sides save a lot of time and can therefore take care of the really important things in life.