On ZEIT.IO, organizations and people are linked by contracts. If you want to add a person to your ZEIT.IO organization then you have to offer the person a contract. There are contracts for freelance workers and contracts for permanent employees. A contract for a freelancer naturally contains the hourly wage that is used in time recording to calculate the wage. A permanent employee can of course also be added to projects and can thus book times for a project. But with what hourly wage is a permanent employee charged in the project? What are the hourly costs of a permanent employee who has a fixed monthly salary?

If you set up a contract for a permanent position at ZEIT.IO, you can either set the gross annual salary or the gross monthly salary. An hourly wage is then calculated based on this input. Here's an example:

Hourly wage for a permanent employee

Hourly wage for a permanent employee

However, a permanent employee costs the company more than just the gross salary! The employer must also pay social security contributions for the employee. As a rule, in addition to the gross salary, the employer has to pay another 25% to the state. That's at least the case in Germany and most countries in the EU. The exact value depends on the state / country / city and on the employee himself. For example, it matters whether the employee is married or not and whether the employee is a member of the church or not. The individual tax class of the employee naturally also plays a role.

In addition to the social security contributions, there are usually additional costs for each employee, such as:

If you set up a contract for a permanent position at ZEIT.IO, you can either set the gross annual salary or the gross monthly salary. An hourly wage is then calculated based on this input. Here's an example:

Hourly wage for a permanent employee

Hourly wage for a permanent employeeHowever, a permanent employee costs the company more than just the gross salary! The employer must also pay social security contributions for the employee. As a rule, in addition to the gross salary, the employer has to pay another 25% to the state. That's at least the case in Germany and most countries in the EU. The exact value depends on the state / country / city and on the employee himself. For example, it matters whether the employee is married or not and whether the employee is a member of the church or not. The individual tax class of the employee naturally also plays a role.

In addition to the social security contributions, there are usually additional costs for each employee, such as:

- Office costs

- Hardware cost

- Costs for SaaS tools per employee (SaaS = Software-as-a-Service, e.g. Office365, Pipedrive, etc.)

- Additional benefits

- And so on ..

Thus, the actual hourly wage of an employee is of course higher than just monthly gross salary divided by 160 hours. The actual hourly cost of a permanent employee varies from company to company and from employee to employee. It is not uncommon for the actual costs of a permanent employee to be between 150% and 200% of the gross salary. Every company has its own formula to calculate the actual hourly rate.

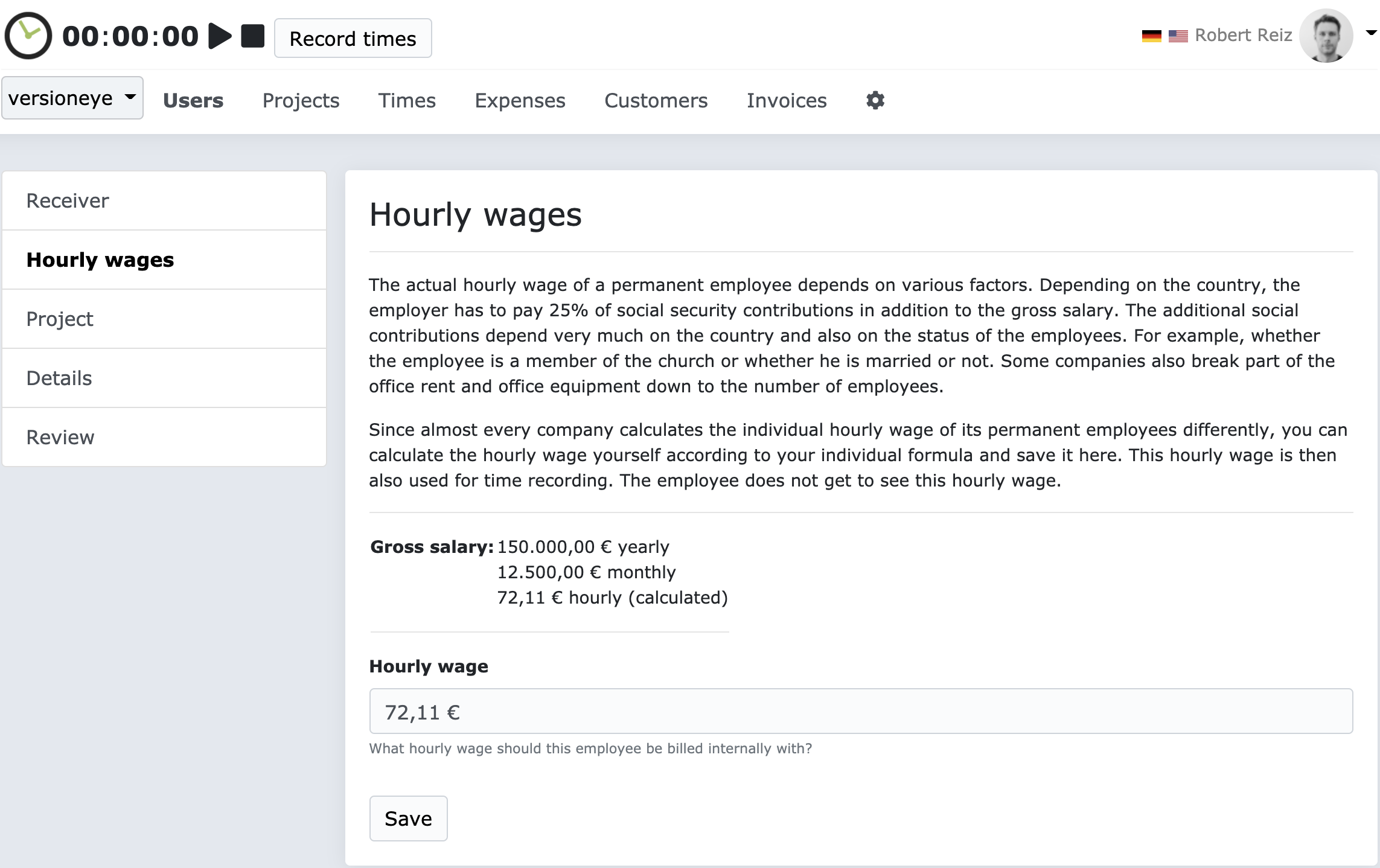

That is why ZEIT.IO now offers the option of explicitly setting the hourly wage for permanent employees.

Setting hourly wage for permanent employees explicitly

Setting hourly wage for permanent employees explicitlyIf you set up a contract for a permanent employee then you have the option of setting the hourly wage explicitly on the second page. The hourly wage calculated by ZEIT.IO is still displayed, but this should only serve as a guide. The actual hourly rate is always higher than the hourly rate calculated by ZEIT.IO.

The hourly wage set here is very important for calculating project costs. If a permanent employee books times for a project, his times are offset against the hourly wage stored here. This is how the actual costs incurred for the project are calculated.

This is not to be confused with the billing rate, which can be set separately for each employee in the project. On ZEIT.IO you can save a billing rate for each employee in the project. This is usually the hourly rate that you charge your customer. The difference between the billing rate and the hourly wage is the company's margin.